The anti-dumping duty (ADD) measure seems to be rearing its head again. This is because there is a lurking fear in the minds of textile industry leaders that the Central government has something up its sleeves on the ADD front. What is the proposal and what are the items that will bear the burden is not immediately known. But the move coming at it does after the government has promised to address the industry’s concerns at the quality control orders (QCS) and the almost reduced burden from the 17 year old goods and services Act (GST), the industry’s fears appear genuine.

The government proposal will certainly undo the effects of both GST and QCOs. Textiles are among the 773 products covered by 191 QCOs at present. There is however a recognition that QCOs may be applied on a fewer products to ensure that supply chains remain uninterrupted and help easy implementation and a NITI Aayog panel has recommended the scrapping of several QCOs.

ADD, an enabling provision is allowed with some conditions under the WTO, which came into force on January 1, 1995. There is a dispute settlement body which will grant a 90 day a period for both parties – one which imposes the duty and the other which bears it. If there is no agreement in this period the dispute will go to the appellate body whose decision is binding on both parties.

Failure to implement the decision means the country that imposes ADD can levy a countervailing duty equal to ADD based on what is known is “normal value”, that is if a product is sold by China in domestic market below the normal price. The normal price is the price at which the product is normally sold in the domestic market. The difference between the two constitutes dumping. But this decision can again be challenged by the aggrieved party that is China. India has used ADD the maximum on a large number of products coming from China, Bangladesh and others. US and other countries have also resorted to ADD to protect their domestic industry.

There is a Directorate General of Anti – Dumping and Allied Duties functioning under the commerce ministry for the past few years. It is headed by an additional secretary rank in the ministry. Its findings on whether there is dumping or not will go to the finance ministry which will impose ADD. It is for a period of 5 years initially and can be further extended, after a review of the situation. At the moment the WTO is “defunct” with no appointments to the appellate body after the Trump administration launched a tariff war with India and certain other countries in April this year.

Textile industry bigwigs opine that ADD measure to curb cheap imports from say, neighbouring China cannot be the right solution. Instead, attempts should be made to find out the cost elements, like power cost, labour cost etc. that have helped China to manufacture these items at lower costs. Cost difference can be compensated through the production linked incentive (PLI) scheme introduced some years ago. Further mass consumption items such as polyester and viscose be outside the ADD ambit. In nut shell raw materials should be made available to the Indian industry at international prices.

Textile industry bigwigs opine that ADD measure to curb cheap imports from say, neighbouring China cannot be the right solution. Instead, attempts should be made to find out the cost elements, like power cost, labour cost etc. that have helped China to manufacture these items at lower costs. Cost difference can be compensated through the production linked incentive (PLI) scheme introduced some years ago. Further mass consumption items such as polyester and viscose be outside the ADD ambit. In nut shell raw materials should be made available to the Indian industry at international prices.

This is because Indian prices are ruling higher than world prices. Competitors – Bangladesh, Vietnam and others it have access to such raw materials. India, on the other hand, has imposed QCOs on MMF materials, affecting their flow. Non availability of these materials at global prices has been affecting the cost competitiveness of the downstream Industry which accounts for the maximum share of textiles and apparel exports, but also have the highest employment elasticity. India’s staple fibre polyester prices have come down from Rs.110 in March 2024 to Rs. 50 in January 2025. During this period viscose staple fibre (VSF) prices too have fallen from Rs.170 to Rs. 19 compared to international prices, according to Southern India Mills Association analysis.

Compared to cotton, a national fibre, MMF fibre has advantages in terms of low cost, versatile design, improving wearing cost, easy to control quality etc., Increasing cotton cost has forced consumers is shift to low cost and durable fibre clothing.

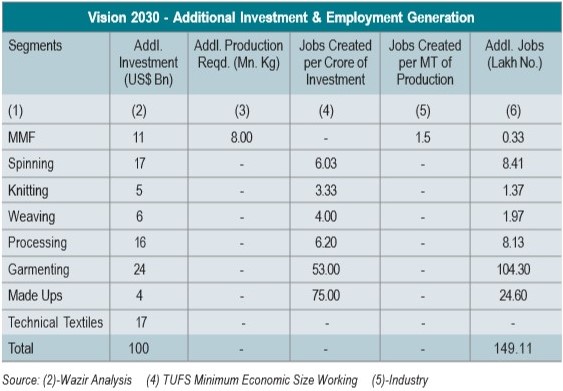

The government’s vision 2030 comprise domestic size of dollar 200 bn and exports of dollar 150 bn. To achieve the target, it is essential to increase the availability the raw materials (fibres and filaments from 11 bn kg to 20 bn kg, and the MMF from the current level of 4 bn kg to 9 bn kg (40 percent fibre and 60 percent filament). Besides, it is necessary to diversity, modify and install textile and apparel manufacturing facilities that can process MMF fibres and filaments and encourage the industry to produce global market’s top 200 MMF products.

Industry considers QCOs as a major “irritant” in doing business and its suggestion is that inputs should not be subjected to QCOs and only the final products. Industry which relies are Chinese inputs are particularly worried as their supplies have been hit. This is amidst arguments put forward by some ministries that QCOs have led to cheap imports being substituted by local production. Industry leaders also complain that the standards have been devised in a way that even products sold the EU and US are not compliant with Indian norms.

Commerce and industry minister asserts that QCOs are designed to ensure that domestic consumers get the same quality of goods that are exported. In the past two quality of the same items were produced. Besides QCOs have helped revive businesses and the feed back is that consumers do not have to bear additional costs. The aim is also to ensure that micro, small and medium enterprises are not adversely affected.

There is also need for better Centre and state collaboration for instance by effectively implementing incentives. They could provide land and the centre supports infrastructure to promote industry. To improve investor confidence better law and order, time bound approvals and minimal physical interface between investors and government are necessary.