The textile and apparel industries have become a vital contributor to the Indian economy over the years. The Indian Textile and Apparel Market reached a value of $151.2 bn in 2021. According to IMARC Group, the market will reach $344.1 bn by 2027, growing at a CAGR of 14.8 percent between 2022 and 2027.

The textile and apparel industries have become a vital contributor to the Indian economy over the years. The Indian Textile and Apparel Market reached a value of $151.2 bn in 2021. According to IMARC Group, the market will reach $344.1 bn by 2027, growing at a CAGR of 14.8 percent between 2022 and 2027.

While India’s exports of cotton yarn, fabrics, made-ups and handloom products in April this year were worth $1158.08 mn, an 8.72 percent year-on�year (YoY) rise, those of man-made yarn, fabrics and made-ups were worth $458.59 mn – an 8.02 percent YoY rise. Overall exports continued robust growth in the month, with merchandise exports crossing $40 bn. The April 2022 merchandise export figure is 30.7 percent higher than the April 2021 figure of $30.75 bn.

The positive trend continues for retail businesses across the country as April 2022 sees the apparel sector’s sales grow by 23 percent compared to April 2019 (pre-pandemic level). Notably, when compared to April 2021, the growth is 42 percent.

Nevertheless, high yarn prices are posing a problem for the garment manufacturing units as most of them are MSMEs. Since 2020, yarn prices have increased by 110 percent. The buyers have already absorbed the increase in prices by two to three times since the yarn prices have gone up. Taking new orders and delivering goods on time is becoming difficult. This is hurting the entire cotton value chain, including the yarn and cotton garment manufacturers. The industry wants a ban on cotton exports from India to put a check on the rising prices.

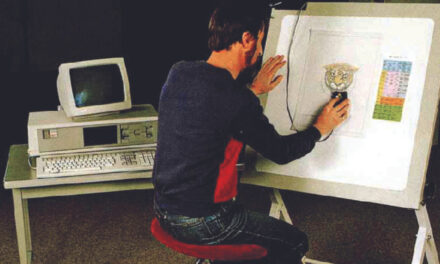

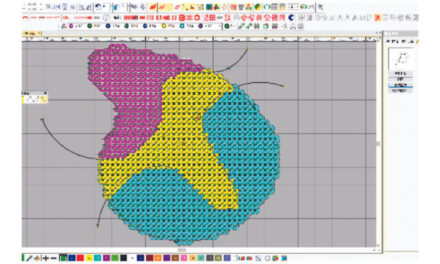

Furthermore, the increasing investments by the Government of India (GoI) in the upgradation of the textile infrastructure by the widespread integration of advanced technologies with the production processes, such as the Scheme for Integrated Textile Parks and the Technology Upgradation Fund Scheme, are creating a positive outlook for the market.

The textile and apparel industries have become a vital contributor to the Indian economy over the years. The Indian Textile and Apparel Market reached a value of $151.2 bn in 2021. According to IMARC Group, the market will reach $344.1 bn by 2027, growing at a CAGR of 14.8 percent between 2022 and 2027.

The textile and apparel industries have become a vital contributor to the Indian economy over the years. The Indian Textile and Apparel Market reached a value of $151.2 bn in 2021. According to IMARC Group, the market will reach $344.1 bn by 2027, growing at a CAGR of 14.8 percent between 2022 and 2027.