When polyester yarn (40s) is available at around Rs.180/kg in Vietnam, Indonesia, and Thailand – but costs Rs.190–210/kg in India – Indian yarn spinners face significant pressure. Yet many succeed. How?

When polyester yarn (40s) is available at around Rs.180/kg in Vietnam, Indonesia, and Thailand – but costs Rs.190–210/kg in India – Indian yarn spinners face significant pressure. Yet many succeed. How?

Let’s break it down

Strong Domestic Market & Speed-to-Customer Advantage

€India’s massive garment market ensures huge domestic demand that international suppliers can’t fully penetrate

€Indian mills located near garment hubs – Ludhiana, Tiruppur, Erode, and Surat – deliver faster, more flexibly, and with fewer customs hurdles

€For many buyers, the Rs.5–10/kg cost premium is easily offset by faster supply, fewer logistics issues, and trustworthy service

Integration & Scale: Lower Conversion Costs

€Large players like Reliance, Filatex, Indo Rama, and JBF are often fully integrated – from PTA/MEG feedstock to yarn

€This vertical structure stabilizes input costs, improves margin control, and drives efficiency through high-volume operations

Focus on Value-Added Yarns

€India leads in producing PC (poly-cotton), PV (poly-viscose), fancy, mélange, slub, and dyed yarns-many Southeast Asian mills primarily offer plain polyester

€Value-added yarns typically command Rs.15–25/kg higher margins, helping Indian manufacturers compensate for their raw price disadvantage

Strong Buyer Relationships & Reliable Service

€Most Indian mills offer custom blends, flexible credit options, fast resolution of issues, and consistent quality – building deep longstanding relationships

€Buyer’s value reliability and responsiveness – factors that often outweigh minimal price differences

Policy Backing & Protection

€India applies import duties on synthetic yarns, making cheaper imports less attractive unless bulk volumes justify it

€Export incentives through PLI schemes, RoSCTL, and other trade policy tools further boost competitiveness for domestic players

Keeping Pace with Sustainability & Compliance

€With global buyers demanding ESG compliance, traceability, and recycled content, leading Indian firms are investing proactively in:

€Recycled polyester and rPET yarns

€Certifications like GRS (Global Recycled Standard)

€Carbon footprint tracking and transparency

€This sustainability edge commands better pricing, even internationally

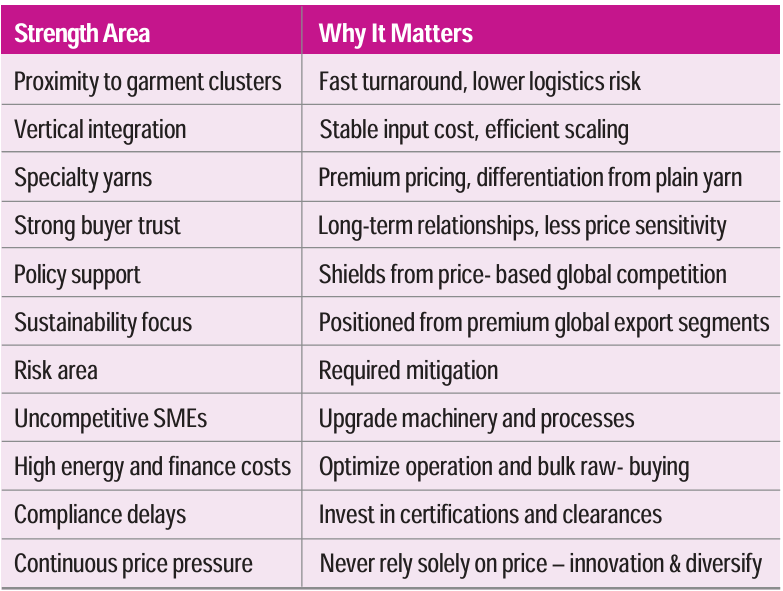

Strategy Table: Key Strengths vs. Risks

Final Thought

Indian polyester yarn spinners may not always compete on price – but they can lead on service, integration, sustainability, and innovation.

In an era where reliability, speed, and ESG credentials matter, being just Rs.10–20/kg more expensive isn’t a deal-breaker. It’s about offering value, trust, and differentiation.

Sathyanandan Prabakaran