• India’s apparel retail market is expected to grow with increasing contribution from e-commerce and value fashion.

• Store expansion to be primarily in the value segment and affordable ethnics. Tier-2 and Tier-3 cities in India are emerging as major growth hubs for retailers, driven by higher disposable incomes, digital adoption, and evolving consumer preferences.

• The e-commerce sector is projected to grow faster than brick-and-mortar stores, fuelled by increasing internet penetration, convenience and Gen-Z’s influence on fashion trends.

Apparel Retail Market Size

Apparel Retail Market Size

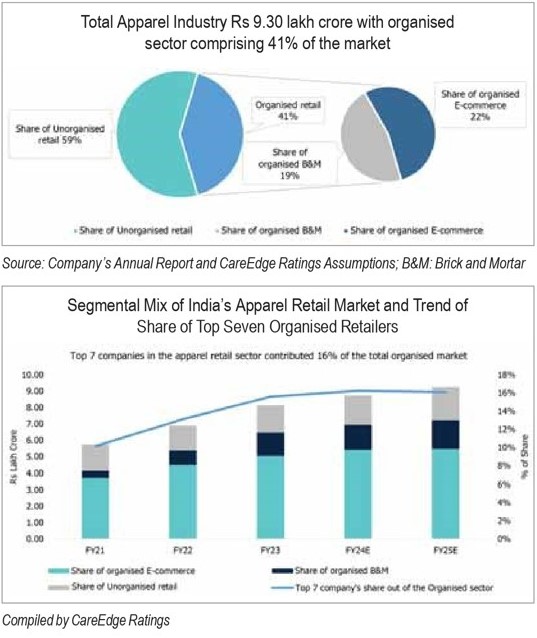

India’s retail sector is undergoing a significant transformation, shaped by evolving consumer preferences and rapid digitalisation. The apparel market, valued at Rs 9.30 lakh crore in FY25 (Estimated), has expanded at a compound annual growth rate (CAGR) of 7% since FY18 and is projected to reach Rs 16 lakh crore by FY30. This growth is fuelled by rising disposable incomes, urbanisation, and the increasing dominance of e-commerce, particularly in Tier-2 and Tier-3 cities. The organised retail sector, accounting for 41% of the overall market, is set to grow by 10-13%, spurred by the entry of international brands, consumer preferences for branded and structured retail formats, the rising appeal of value fashion, and the shift towards online shopping.

E-commerce, accounting for 22% of the organised retail market, is a major growth driver, projected to reach Rs 5.0 lakh crore by FY30 (25% of the organised retail market by the end of FY30), driven by the expansion of online platforms and digitalfirst brands.

Recent Industry Trends

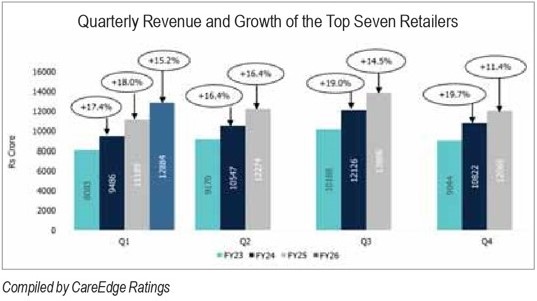

The apparel market encountered notable challenges in Q2FY25, with inflationary pressures dampening consumer demand. Year-on-year sales growth moderated in FY25 compared to FY24, further influenced by subdued demand and extreme weather conditions. However, signs of recovery began to emerge from October/ November 2024, driven by increased foot-falls and sales during the festive and wedding seasons. The expansion of online sales events and the growing adoption of omnichannel strategies by brands have accelerated e-commerce growth, positioning digital platforms as key drivers of future sales performance.

The apparel market encountered notable challenges in Q2FY25, with inflationary pressures dampening consumer demand. Year-on-year sales growth moderated in FY25 compared to FY24, further influenced by subdued demand and extreme weather conditions. However, signs of recovery began to emerge from October/ November 2024, driven by increased foot-falls and sales during the festive and wedding seasons. The expansion of online sales events and the growing adoption of omnichannel strategies by brands have accelerated e-commerce growth, positioning digital platforms as key drivers of future sales performance.

Growth Momentum to be Supported By

Value Fashion led growth: India’s value fashion market, estimated at Rs 3.5 lakh crore in FY24, is set to expand at a CAGR of 7%, reaching Rs 5.0 lakh crore by FY30. This growth is driven by rising brand consciousness and fashion awareness, particularly in Tier-2 and Tier-3 cities, where evolving consumer preferences are reshaping the retail landscape.

These regions are becoming key growth hubs, supported by improved infrastructure, greater digital access, and higher living standards. Consumers in these areas are now more aspirational and brand-aware, with growing purchasing power enabling them to explore the latest fashion trends.

Value retailers are capitalising on this shift by offering stylish, high-quality apparel at competitive prices, positioning themselves as strong alternatives to local boutiques. Brands such as Zudio, Max Fashion, and Reliance’s Yousta are expanding rapidly to serve fashion-conscious yet price-sensitive consumers, further strengthening the market.

E-commerce is a significant driver of organised retail growth: India’s digital infrastructure is pivotal to this growth. With over 955 million internet users and e-commerce penetration in the apparel market expected to reach 25% by FY30 (up from 22% currently), the digital fashion space is poised for significant expansion. The rise of brand-owned websites as a preferred sales channel is helping brands build direct relationships with consumers, gain valuable insights, and improve profitability.

Growth in Tier-2 and 3 cities: Focusing on these cities has helped retailers unlock their consumption potential. Approximately 23% of total apparel demand is expected to come from these cities, with significant demand in the value segment. Organised value retailers have led the transition of the Value Apparel segment in these cities from largely unorganised to somewhat organised. The ability to offer quality products at affordable prices in retail environments has been a key driver of the widespread acceptance of these formats across Tier-2 and 3 cities.

Focus on Private Labels: Private labels are expected to account for a substantial portion of the retail industry by 2030. Largely all value retailers are private labels led with some national brands included to complete the retail offering. Investments in robust product design and development capabilities and a focus on privatelabel development across categories have been key factors enabling Value retailers to offer fashionable products at affordable prices and to improve margins.

Impact of recent GST changes on pricing and demand across segments:

Impact of recent GST changes on pricing and demand across segments:

Positive for Value Segment (= Rs 2,500)

• Post-GST, apparel priced below Rs 2,500 carry a reduced effective tax burden of 5% (earlier 12% for items priced between Rs 1,000 to Rs 2,500), allowing retailers to lower prices, benefiting consumers and boosting sales volumes

Neutral-to-Negative for Mid/High Price Segments (over Rs 2,500)

• Apparel priced above Rs 2,500 falls under the higher GST bracket of 18% (up from 12% earlier), prompting price-sensitive consumers to shift toward more affordable options – impacting demand for premium clothing. To remain competitive, retailers may strategically offer discounts or bundle products. Retailers may need to absorb part of the tax or offer discounts, squeezing margins.

CareEdge Ratings’ View

The credit profiles of India’s apparel retailers have shown mixed trends in recent years. Revenue growth for several players has been driven by expansion into Tier1 and Tier-2 cities, the launch of private-label products, and a sharper focus on value fashion, whereas others have experienced stagnation. In the last four years, retailers have prioritised scaling operations through private labels and affordable formats, which supported operational profitability. “Looking at FY26 and beyond, the industry outlook is favourable. E-commerce and online sales will expand rapidly, fuelled by internet penetration and Gen-Z’s fashion influence. At the same time, brick-and-mortar outlets will continue to dominate premium purchases due to the importance of the in-store experience. Value fashion in Tier-2 and Tier-3 cities is expected to emerge as a major growth driver, supported by rising disposable incomes, expanding trend of occasion-based dressing, and ecommerce,” says Sonal Bhageria, Associate Director, CareEdge Ratings.

“Balancing expansion and enhancing omnichannel capabilities while implementing cost-optimisation measures will be crucial for maintaining profitable growth and a stable credit profile for the apparel retail sector. Efficient inventory management and a stronger digital presence are expected to further enhance operating performance while catering to evolving consumer preferences,” says Pulkit Agarwal, Director, CareEdge Ratings.

By CareEdge Ratings