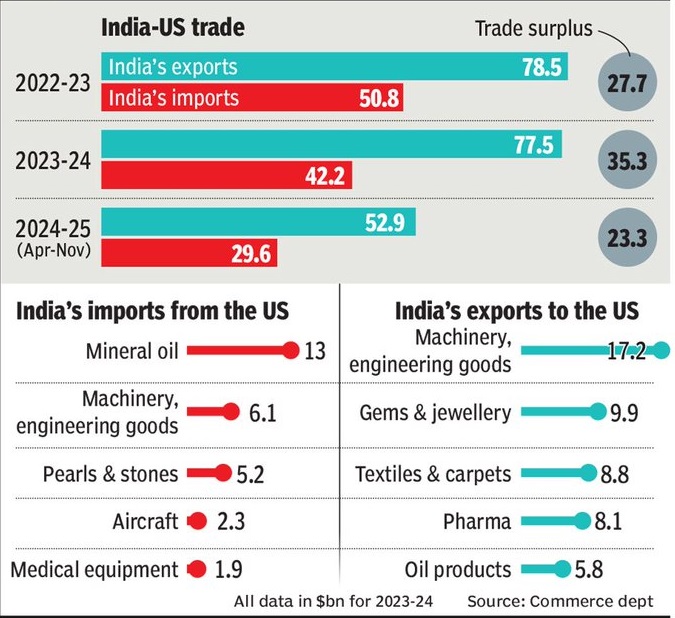

While the additional US tariffs totaling 50 percent will adversely affect our textile sector, among other industries, New Delhi has been and is handling the situation diplomatically. In the short term, some incentives have to be given to exporters even cash assistance, as was the case a few decades ago. RBI has also stepped in with measures to cushion the tariff impact, along with government steps promised by Finance Minister Nirmala Sitharaman.

In the long term, New Delhi has to continue negotiations with the US authorities to reach a limited trade agreement. There is no other option. Diversifying into new markets is not easily possible but is also time consuming. There are reports that India is expected to sign the deal in November this year.

India has a big stake in the US as regards textile exports, which constitute roughly 30 percent of our total textile exports, among the export items are garments, fabrics and yarn.

The US administration is specifically targeting India. Which means it is country specific tariff. This is against the UN Charter and also WTO rules. So India can consider imposing a countervailing duty on American goods to partly offset the loss on exports. Consider, India is among the poorest among countries with a low per capita income compared to the USA, though India is the fourth largest economy in the world and is a population country too.

The US administration is specifically targeting India. Which means it is country specific tariff. This is against the UN Charter and also WTO rules. So India can consider imposing a countervailing duty on American goods to partly offset the loss on exports. Consider, India is among the poorest among countries with a low per capita income compared to the USA, though India is the fourth largest economy in the world and is a population country too.

The recent government’s decision to grant import duty exemption on cotton till December end this year is a welcome move. Industry has been demanding that exemption be given during the lean period i.e. April – October this year.

This is because farmers sell 90 percent of their cotton produce during November- March every year. Industry leaders say that the exemption at the beginning of this season might impact the farmers. It was however, noticed that the 11 percent import duty was imposed at a time, when India was exporting around 30-40 lakh bales (170 kg each) cotton annually. At present, production has fallen below 295 lakh bales against the Industry’s requirement of about 318 lakh bales as estimated by the Committee on Cotton Production and Consumption (COCPC).

Southern India Mills Association Chairman Dr. S.K. Sundararaman has said the decision has led to the lowest closing stick, resulting in a shortage of raw material that could severely affect the capital intensive cotton value chain which provides direct employment to nearly 35 million people. It is essential to make available cotton at internationally competitive process.

From the Government’s side, apart from financial assistance, progress is being made in concluding FTAs with the EU and other potential countries. The Finance Minister had said that the government is committed to address all concerns of the exporting community. She also underlined the importance of protecting workers livelihoods. She called upon the industry leaders to reassure employees of job continuity even amidst global headwinds. The immediate focus is Europe with FTAs signed with the UK and EFTA bloc and one with the EU. The commerce department is working out a strategy on 50 countries.

Industry leaders have welcomed the GST council’s meeting on Wednesday (Sept4) to reduce the rates on MMF items. Earlier, the rates on some of these items were high. PTA and fibre carried a 18 percent rate. In the case of textile items, the rates remain at 5 percent. But the leaders want the same for all industrial raw materials.

Industry leaders have welcomed the GST council’s meeting on Wednesday (Sept4) to reduce the rates on MMF items. Earlier, the rates on some of these items were high. PTA and fibre carried a 18 percent rate. In the case of textile items, the rates remain at 5 percent. But the leaders want the same for all industrial raw materials.

Again critical inputs for the industry, including high speed diesel, petro materials, gas and fuel are outside the GST ambit. At a recent GST council meeting, the Finance Minister had said, “the law has a provision for their inclusion, but it was for the states to first decide on it and then for the rate of tax”. Capital goods, that is machinery, does not get refund of GST and the government has said No to the five items has five rates, namely Nil, 5 percent, 12 percent, 18 percent and 28 percent. GST has not been extended to alcohol liquor for human consumption.

It is to be noted that global textile and apparel exports had grown at a compounded annual growth of 3.4 percent in the last 6 years. India’s exports grew at 0.8 percent only due to geo-political uncertainties, consumption shift to other discretionary and essential items.

According to Confederation of Indian Textile Industry (CITI) “given the huge and increasing demand in global markets and our marginal presence at present MMF based textiles can drive up a phenomenal growth of our textiles industry for the apparel, home textile, yarn or technical textiles by 2030. It is expected that polyester – the most important among MMFs will cover 60 percent share of the total fibre demand whereas cotton about one – fourth share.

The time has come to switch over to polyester or viscose, looking at the vast scope for increasing consumption of MMFs in the country. The share of MMF production the total textile production is considerably lower than that of world average. In fact, the share of MMF products in exports is even lower than that of total production. Exports of MMFs worldwide is worth dollar 158 bn compared to India’s just dollar 6.5 bn. Global MMF consumption is slated to touch 76 percent by 2030 from 71 percent in 2010. Our current reputation in the global market is basically as efficient supplier of fibre, yarn and filament fibre. Our presence in the final products of garments and made-ups is limited.