The India-European Union talks are on signing a Broad-Based Trade and Investment Agreement (BTIA) what has, however, lent more weight to the negotiations is the reassuring words from German Chancellor Olaf Scholz, ahead of his visit to India along with a business delegation. He said he and Indian Prime Minister Modi were committed to finalising the deal.

The India-European Union talks are on signing a Broad-Based Trade and Investment Agreement (BTIA) what has, however, lent more weight to the negotiations is the reassuring words from German Chancellor Olaf Scholz, ahead of his visit to India along with a business delegation. He said he and Indian Prime Minister Modi were committed to finalising the deal.

“We want to further deeper trade relations between India and EU and that is why we speak strongly for the FTA. It is an important topic and I will get personally involved to ensure that this does not drag-on he said… Scholz said a future balanced, ambitious comprehensive and mutually beneficial trade and investment agreement between India and EU all benefit both the Nations. That’s why Germany was strongly supporting the negotiations. Germany is the second largest state after the United Kingdom in the EU and the reassuring statement from Scholz assumes added significance in the context of the current negotiations that have dragged on for a number of years now.

But the million dollar question is Will the deal come through in view of the present global scenario the continuing war between Russia and Ukraine gloomy, economic outlook, fall in commodity prices etc. We have to wait and watch.

Modi’s keen interest in the agreement is because it promises to make India more competitive and boost exports. That will happen as the tariff imposed say on ready –made garments, fabric etc. will get dismantled. Currently, RMGs are charged at 9.6 percent against 12 percent before. This is after a 20 percent deduction on the tariffs slapped by EU instead of getting benefits under EU’s Generalised Scheme of Preferences (GSP) plus scheme.

Like RMGs, tariffs on fabrics at 8 percent and yarn at 4 percent will be off. Currently India – EU textiles and clothing trade is valued at dollar like RMGs tariffs on fabrics at 8 percent and yarn at 4 percent will be off. Currently India- EU textiles and clothing trade is valued at dollar 10 billion. If the FTA is signed, it has the potential to increase India’s exports to EU by atleast dollar three bn per year.

India has been facing a “discriminatory” tariff regime vis-à-vis its competitors like Pakistan and Turkey EU. Bangladesh also receives duty – free access to its garments exports to the EU. And once the FTA comes into force, India will be at par with least developed countries such as Bangladesh and others and gain duty – free access in EU. EU’s specialised textiles products will also be able to enter the Indian market duty free.

India has been facing a “discriminatory” tariff regime vis-à-vis its competitors like Pakistan and Turkey EU. Bangladesh also receives duty – free access to its garments exports to the EU. And once the FTA comes into force, India will be at par with least developed countries such as Bangladesh and others and gain duty – free access in EU. EU’s specialised textiles products will also be able to enter the Indian market duty free.

Negotiations between India and EU have been on since 2007 but have got stalled on thorny issues such as high tariffs on Scotch whisky and automobiles. India had reduced duty on whisky from 150 percent to 100 percent. On government procurement where the EU wishes to participate, New Delhi has not so far agreed to consider this demand. Another reason for the statement in talks was New Delhi’s decision to cancel bilateral investment treaties with 22 EU countries in 2016, slowing down interest from European companies to invest.

Needless to say, EU is one of the largest trading partners for India. BTIA will help increase trade between the two, apart from increasing the volume of trade, the BTIA would have several additional advantages such as technology and knowledge transfer, infrastructure development, improvement in supply chains, more job opportunities skill development which will ultimately widen and deeper the relationships.

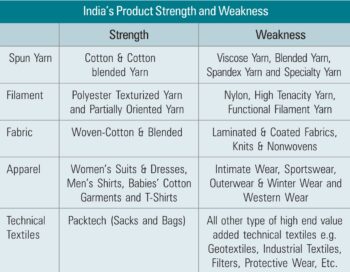

The impact of the India FTA on the textiles and apparel sector will be significant in terms of increasing market share, investment in R and D, efficiency and production of economies of scale. It is also expected to result in increased job opportunities in India for both skilled and unskilled workers.

As the first India-EU virtual summit in New Delhi a few months ago EU President Unsula Von der Leyen had said the EU sought n “ambitious” free trade deal with India and the high-level dialogue would help the two sides towards achieving that goal.

As is already known, EU’s preferential duties are applied discriminately against India vis-a-vis its competitors. Almost the same case in respect of duties applied by the United States and China. In the US, India’s apparel exports attract an average duty of 10.2 percent while nil rates are imposed on imports from Bangladesh and Ethiopia in the EU and zero duty on imports from Ethiopia in the US. In China, Indian fabrics are charged at 8.5 percent duty, while no duly is slapped on the same item entering from Pakistan. India has already lost out 37 fabric items to Pakistan due to zero duty access to Pakistan granted by EU.

The textiles and clothing industry has been greatly affected by the phenomenon of globalisation. Europe and the US are not only important producers of textiles and clothing products, they are also the most attractive outlets for the exporting countries, many of which are located in South East Asia. Many developing countries as well as least developed countries have emerged competitive in textiles and clothing as they combine low wage costs with high quality textile equipments and know how imported from more industrialised countries.

In 2005, the process of trade liberalisation – which started in 1995 with the signing of the WTO Agreement on Textiles and Clothing (ATC) will have been completed. It will bring about a new world order in textiles trade, since large textiles countries like China, India or Indonesia will no longer be faced with quantitative restrictions when exporting to the EU or US. The EU textiles and clothing industry strives to remain competitive through higher productivity and competitive strengths such as innovation, quality, creativity, design and fashion.

These competitive advantages are the result of a permanent process of restructuring and modernisation. The sector has been adopting new technologies at a fast pace, both with regard to information and communication technologies and new production techniques. Equally, the EU industry has a leading role in the development of new products such as

man-made textile fibre on technical textiles.

It is generally believed that the quality of the European workforce exceeds that of other world regions. Women account for a large proportion of the T and C work a force, in particular in clothing. The industry is dominated by a large number of small and medium enterprises. Most companies are privately owned, and a few are listed on the stock exchanges (mainly in the secondary market). Sub-contracting accounts for an important part of activities of the T and C industry.