India’s trade deficit with China – estimated at a little over dollar 100 billion in 2022 will climb up further, without a sizeable increase in its exports. Now products have to be identified which have a big demand in China, apart from those already being exported. From the textile industry side, cotton and cotton yarn are the two items, the exports of which need to be stepped up.

India’s trade deficit with China – estimated at a little over dollar 100 billion in 2022 will climb up further, without a sizeable increase in its exports. Now products have to be identified which have a big demand in China, apart from those already being exported. From the textile industry side, cotton and cotton yarn are the two items, the exports of which need to be stepped up.

But with the Chinese spinning industry becoming weak the possibility of more cotton yarn exports is practically nil. For, Beijing has invested heavily in Vietnam in the field of spinning to produce cotton yarn and in textile units for turning into fabrics or garments to cater to requirements of its clients in Europe and elsewhere and to those to whom Vietnam exports, these products. Already Vietnam has the most modern textile industry, much more than India. It has emerged as a major competitor to India. India’s yarn exports to China have been declining for the past few years.

Spinning is a capital intensive industry and is very important for the value added sector to develop and thrive. Currently, India has 52.45 million spindles and 8.76 lakh rotors spinning capacity. There is excess capacity of yarn for exports and the low demand in the global market has forced a large number of mills to cut back on production. There was a limited growth in the spinning sector in the past few years owing to reduced demand for yarn exports.

Chinese customs data show that trade between the two countries touched an all time high of dollar 136 billion in 2022, surpassing the dollar 125 billion mark a year ago. Chinese exports to India rose to dollar 119 billion, a 22 percent increase in this period. India’s imports declined by 30 percent to dollar 17.5 billion. The trade defect stood at dollar 69.4 billion in 2021. The overall trade with China totalled dollar 126 billion, a 43 percent increase year in year. India’s exports to China increased by 34.3 percent year on year to reach dollar 128 billion in 2021. The trade between the two countries continue to boom, despite border tensions. The rapid expansion of bilateral trade since the beginning of the century has pushed China to emerge as India’s largest goods trading partner.

While there is a dire need to step up exports to reduce the trade deficit, there is no easy to do that. This is because India is dependent on a whole lot of raw materials – be it for the electronics sector, pharmaceutical industry or the textile sector – from China. Even buttons and zippers for T-shirts and trousers come from China.

While there is a dire need to step up exports to reduce the trade deficit, there is no easy to do that. This is because India is dependent on a whole lot of raw materials – be it for the electronics sector, pharmaceutical industry or the textile sector – from China. Even buttons and zippers for T-shirts and trousers come from China.

Now let’s look at the Chinese waning presence in the global textile and apparel trade. Following the economic crisis in China in 2009 its growth in the global apparel and textile trade slowed down. This trend is expected to continue in the future as well. The present apparel market is estimated at dollar 237 billion and it is growing the rate of 15 percent since 2007.

According to a study by Wazir Advisors, China’s per capita expenditure on apparel has also grown at percent to reach a level of dollar 171 billion during the same period. This shows that the domestic demand of apparel in China is growing and will reach dollar 615 billion by 2025. This will put pressure on its exports and focus will shift to domestic suplies.

Here is the opportunity for India to increase its share of the global market being gradually by China. India, as the largest and more resourceful country, has the capability to take maximum advantage because of its huge textile base, adundant manpower and infrastructure. But is has to fully tap its potential as far as apparel exports are concerned. Large scale structural changes in policy framework is necessary. It has to start from reforming of labour laws to exit policies to fast track the approval process. Moreover, finalisation of an FTA with EU can bring about a huge positive impact on Indian apparel exports.

Most large international buyers are now adopting the “China plus one sourcing model where they are active in at least one other country than China. Bangladesh’s infrastructure cannot support the high growth it witnessed in the last decade. This apart social and environmental compliance in Bangladesh are already under question. In Vietnam, East Africa, Myanmar etc., there are issues of labour, unrest, political instability etc., In comparison India is a far better and stable sourcing destination of international buyers.

India enjoys the position of being the second largest exporter of textiles products in the World. However its share in the global exports tells a different story. It is a mere 5 percent, whereas China’s share is about 41 percent. Italy, Germany and Bangladesh – which are all comparatively smaller countries than India – have a similar share of 4-5 percent in the global trade. This shows that India has not been able to realize its full potential, despite the presence of a complete value chain and abandant supply of cheap and skilled labour.

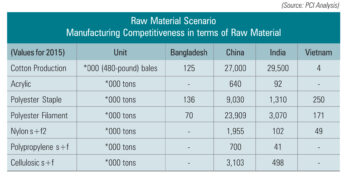

The power cost in India is higher than that in Bangladesh and Vietnam. There are some erratic and limited suppliers in some areas of India and Bangladesh. Vietnam enjoys a lower cost than India and consistent suppliers. China has the highest power cost, but its supplies are consistent and reliable. The lending rates in India are very high than those in China and Vietnam, while it is comparable to those in Bangladesh. High lending rates affect the cost of production and lower its competitiveness.

It is known that man-made textiles and garments are in great demand worldwide. But despite being the second largest textiles exporter, India lags behind in this segment because of non-availability of manmade fabrics at competitive prices. Indian textiles value chain is subjected to a differential tax treatment. On the other hand, China, Pakistan, Sri Lanka, Indonesia and Thailand follow a fibre meutral policy. There is a need to align our production with the world consumption patterns through the introduction of fibre neutral tax policy.

The Indian textiles sector is largely un-organized and small in size, especially fabric manufacturing, fabric processing and garment manufacturing segments. These segments suffer from lacks of capacities and use old technologies. Capacity expansion or technology upgradation is a big challenge for the small and medium scale units with limited resources because of higher risks perceived by lenders and also because of lack of awareness.