The Indian spinning sector is under dire straits due to low demand at home and abroad. The fabrics segment is any the better it already is weak and operates on obsolete technology and depends on government doles. The garment and home textiles sectors suffer from fragmentation. The textiles sector as a whole has been made to accept the transitory cost of implementation of the Goods and Services (GST) Act launched a few months ago and other governmental measures.

The need of the hour is consolidation and modernisation of the fabrics sector. This requires concerted efforts and well thought out measures. Modernisation of weaving and processing also needs focus, besides encouraging production of indigenous shuttleless looms and phase out a large number of shuttle looms which are still being used in the country. The knitting sector also requires consolidation and modernisation since it has the same infirmities as the weaving segment at present. There are only over one lakh shuttle less looms as against 8 lakh in China.

Earlier, prolonged reservation of garments in the small-scale sector had contributed to fragmentation, in addition to unworkable labour laws. The reservation policy was done away with, though the labour laws continue to be as inflexible as before. There is no effective alternative to liberalisation of labour laws, if our garments and home textiles industry have to be upgraded to world standards and empowered to compete effectively. The labour laws prohibit deployment of women in night shift, engaging a worker for more than 48 hours a week and temporary appointment of workers for seasonal jobs.

A loss-making unit needs government’s prior permission for closing its operation, if it employs more than 100 workers. These provisions hurt both employees and employers and therefore need to be liberalised to promote consolidation and merger of units to achieve economies of scale and become cost competitive globally. A political will has to be developed for revamping the labour laws. It is also important to treat garments at par for all government interventions and incentives, since both the segments have identical operations.

Countries such as Bangladesh, Turkey and Cambodia have successfully developed their apparel and textiles sectors, leveraging their duty-free status to the US and the European Union which are the largest consumption bases. India does not have duty-free access to these markets, which gives other countries a major competitive edge over India.

As stated earlier, the fabrics industries face challenges despite being given high importance in the textile value chain. The sector suffers from high cost in competitiveness due to exogenous factors on which a manufacturer has no control. The high incidence of blocked/embedded taxes/levies/surcharge etc. of about 5.33 per cent in the export consignments are not refunded at any stage. This is a vital bottleneck that needs to be taken into consideration while resolving issues of the sector. China gives a 17 per cent rebate on exports, which in effect, amounts to an implied subsidy for its fabrics of 8-10 per cent. Bangladesh grants a 5 per cent subsidy to its garment exporters, if fabrics are made from yarn sourced locally to promote the domestic value chain.

Indian fabrics makers also suffer from high transaction cost. Moreover, interest cost in India is much higher than in China. Hence, the request from the Confederation of Indian Textile Industry (CITI) for including fabrics in the Rebate of State Levies (ROSL) package and providing a 5 per cent ROSL rate for 5-7 years. CITI also wants the benefits under the Merchandise Exports India Scheme (MEIS) for processed fabrics to be increased from two to four per cent.

Surprising as it may seem, Indian Garment manufacturers have to pay duty on imported fabrics. While Bangladesh can import the product from China, duty-free, convert it into garments and sell to India, also duty-free. This has placed the Indian garment industry at a major disadvantage. The situation is not far off when Indian brands shift sourcing from India to low cost duty-free countries such as Bangladesh and Sri Lanka another disquieting feature is that post- GST, there has been a sharp increase in imports of garments from Bangladesh.

A major portion of India’s population is engaged in garment manufacturing, earning substantial foreign exchange. In this regard, it is necessary for the government to revisit the GST provisions with regard to the garment sector to make this business viable and sustainable. Duty drawback and remission of ROSL for the garment sector should continue at the same rates as in the pre-GST regime.

Consolidating fragmented textile units into organised industrial units will need substantial investment in land, building and machinery. Liberal term-loans and working capital at affordable interest would be a positive encouragement. Currently, interest rates available to the textiles and clothing industry of major competing countries are substantially lower than the present prime lending rates in India. In the case of term-loans, TUFS helps handle this problem to some extent. For working capital loans, the industry faces problems both in availability of funds and interest rates. Providing adequate capital at affordable cost for both capital expenditure and working capital needs focused attention.

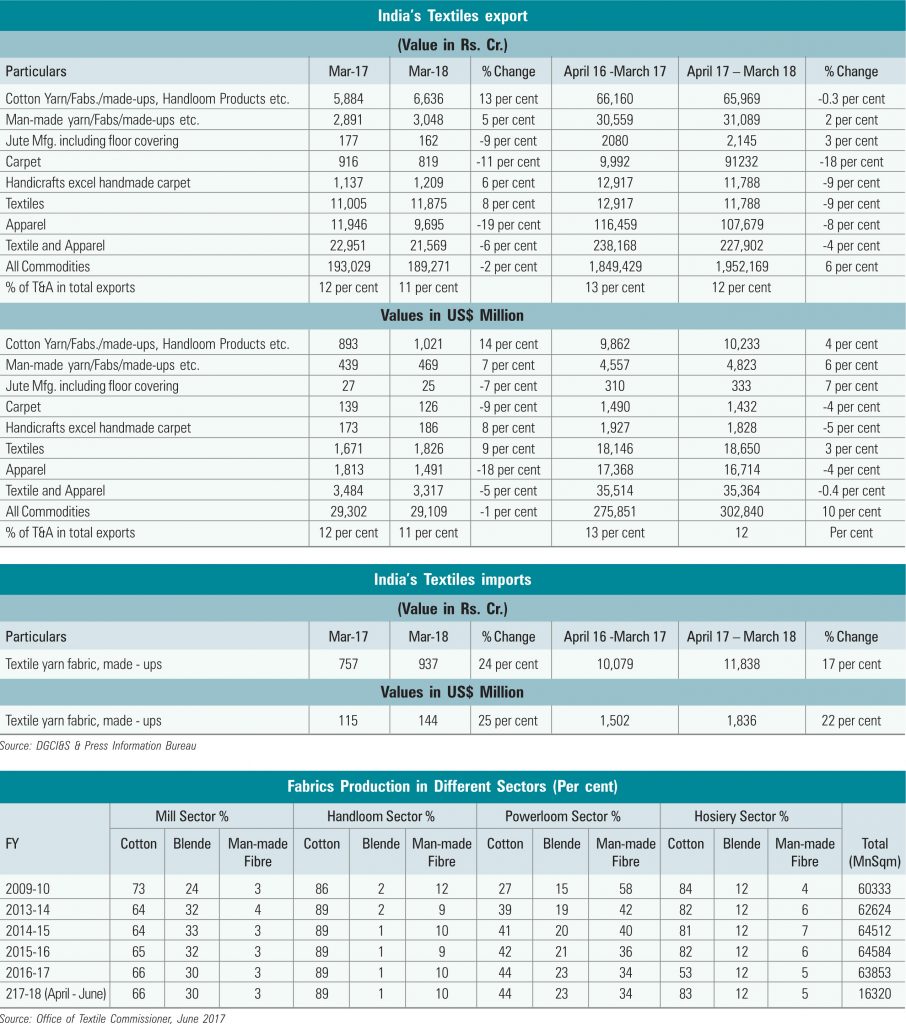

Currently, Indian mill consumption of all fabrics is around 10 mn tonne, of which about 5.3 mn tonne is of cotton only. Clearly, India is a cotton-dominant nation. Continuous efforts should be made to improve the quality of cotton to make the right quality available to the textiles industry. The textiles and clothing industry is keen on engaging with regions such as the European Union to provide reciprocal market access to products of interest to both sides. It may be important to look at some of the demands of the industry. One of them is whether the sector could build value chains across countries where it is seeking FTAs.

India’s top exported categories include cotton fibre, yarn, and woven fabrics, man-made fibre yarn and woven fabrics, knitted garments like T-shirts, woven garments like women’s skirts and blouses, men’s shirts and bed linen, furnishing articles etc. Key global markets for textiles and clothing products are China, Bangladesh and Pakistan (fibre), China, Turkey, Egypt and Brazil (yarn), Sri Lanka, Bangladesh and UAE (fabrics) US, Germany, UK and UAE (garments) and US, Germany and UK (home textiles).