Diversification into new markets has become a necessity after the Trump administration imposed a hefty 50 percent tariff on Indian exports. This measure has dealt a heavy blow to our efforts to secure more market access in the US. Indian exporters have realised that diversification is a must to stay in competition. This diversification initiative has started paying dividends. Total exports exhibited a 10.4 percent growth in November on the back of a jump in shipments. This is the fastest growth in more than three years. Total textile and apparel exports also logged in a 9.40 percent increase in the same month. Thus total exports have defied Trump tariffs. Trade data for November show that exports are diversifying, according to commerce minister Piyush Goyal. New Delhi’s initiative to forge free trade agreements (FTAs) with several countries and negotiations for more such FTAs have also helped export growth. The top three export destinations are the US (dollar 7 bn) UAE (dollar 3.4 bn) and China (dollar 2.2 bn) during the month under review. This higher increase is to be viewed against a negative growth in the previous month i.e. October.

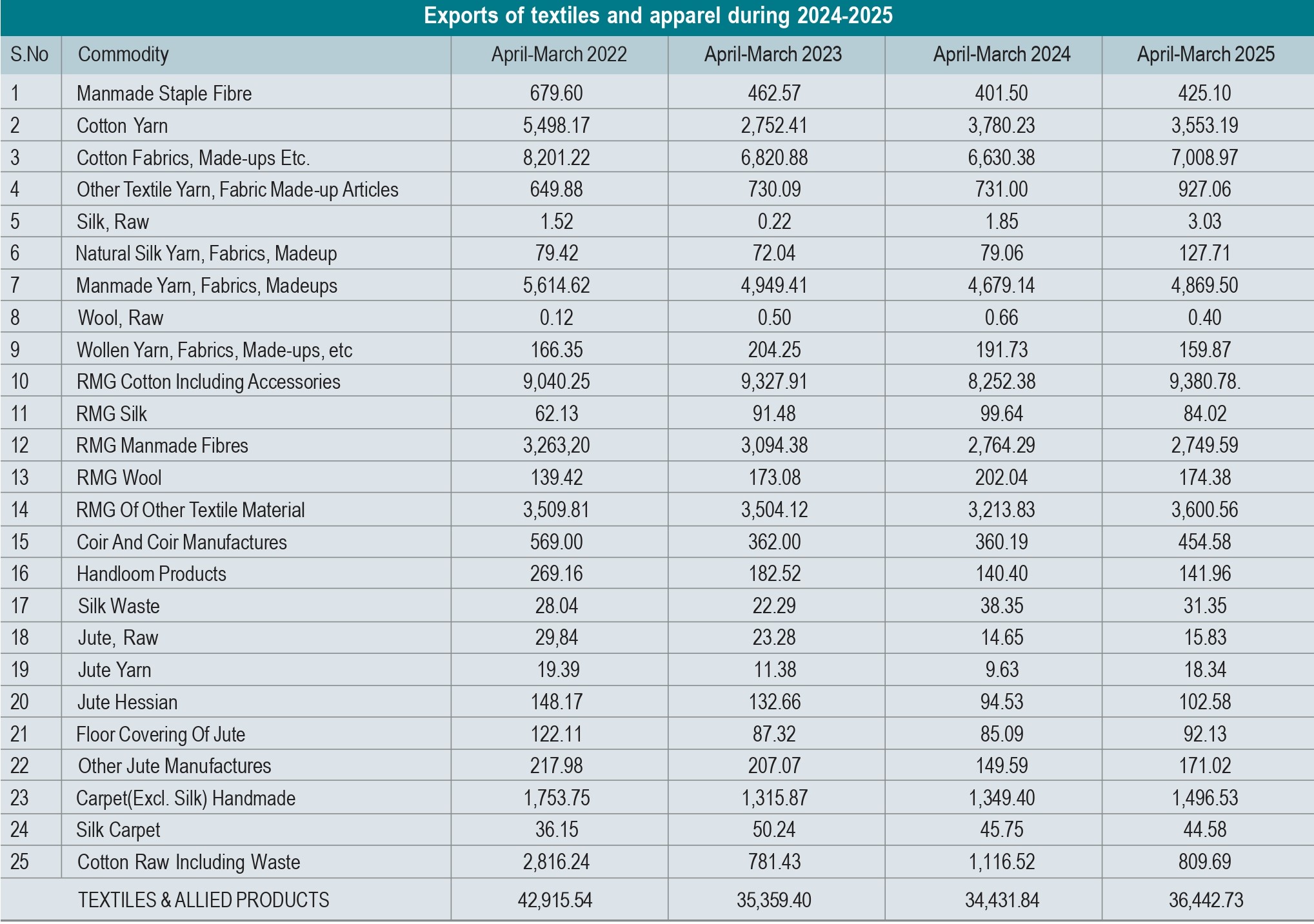

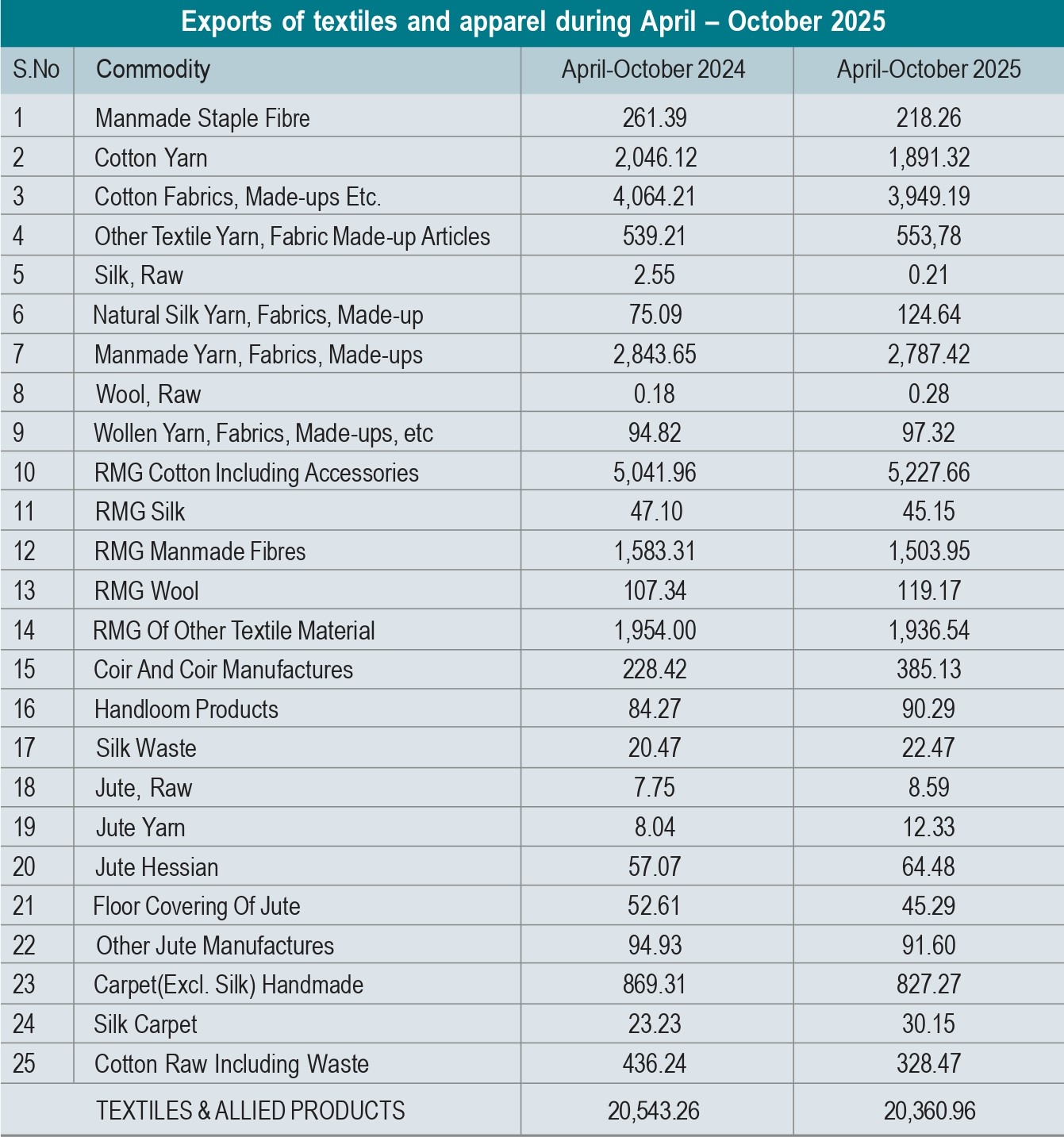

Tamil Nadu is the largest textile exporter contributing 28 percent. The 50 percent tariff led to a decline in exports in September and October (2025) due to cancellation of orders. Diversification helped to mitigate the decline. As a result, exports to certain countries posted a 20 – 50 percent increase. Data show readymade garments (cotton, including accessories) rose to dollar52 bn, from dollar 50 bn in the previous corresponding period. Handloom products were worth 90.29 bn while cotton yarn exports declined from dollar 20 bn to 18 bn after China stopped its buying. Exports of other textile yarn, fabrics made-ups increased from dollar 5.3 bn to dollar 5.5 bn in the period under review. Goyal says “Now export growth has more than made up for October”. Agarwal Commerce Secretary said that in several sectors exporters were diversifying the market.

FTAs have already been concluded with Australia, UAE, Switzerland and Mauritius, Oman and New Zealand. Talks are on with major economies like the EU and the US. These negotiations aim to reduce trade barriers and enhance market access for our products. New Delhi is also planning a preferential trade agreement with Mexico to help exporters avoid paying steep tariffs up to 50 percent. India and Canada are assessing the scope of a trade pack. India and the US are “very close” to finalising the framework for their proposed bilateral trade agreement according to a top trade official.

With the 27 nation bloc European Union negotiations have entered the “most difficult stage” and both sides are engaged to bridge the difference and close the talks soon. Difficult issues are on the table and we are trying to ease that out wherever we are finding a fine balance.

US Carbon border adjustment mechanism (CBAM) is also on the discussion table, the top official said. Last fiscal (2024-25) exports of RMG cotton including accessories posted an increase of dollar 9.3 bn from 8.25 bn in the preceding year. RMG of other textile material rose from dollar 3.2 bn to dollar 3.6 bn. Agarwal says “Despite the tariffs we have been able to hold our exports and imports are also growing (38 percent to dollar 5.3 bn) which is a good thing for India – US trade”. Total exports are estimated to have increased 22.6 percent to dollar 7 bn in November despite the impact of 50 percent additional tariffs, while the value of consignments going to China rose to dollar 2.2 bn. With imports falling two percent to dollar 62.7 bn, the trade deficit narrowed to dollar 24.6 bn, the lowest since June this year.

RBI has taken several steps to mitigate the hardship of exporters. It has extended the period for realisation and repatriation of export proceeds from nine months to fifteen months to assist the textile industry in navigating extra ordinary disruptions in exports.

Additionally, the maximum credit length for exporters pre-shipment and post-shipment export loans has been extended from one year to 450 days for export credits issued through March 31, 2026. These steps are intended to ease the liquidity strain that manufacturers and exporters face due to fluctuations in global demand and supply chain difficulties. Further, banks have beentold to relax margin requirements, making it easier for textile companies to obtain capital to fulfil orders, acquisitions of raw materials and textile production.

With the GST rationalisation, MM fibre based apparel is now much more affordable. The GST rates have been slashed from 18 percent to 5 percent on fibres and from 12 percent to 5 percent on MMF yarns. In addition imports of polyester and raw materials will be streamlined by relaxing quality control orders guaranteeing a steady supply for processors, weavers and spinners. This strategy promotes more efficient production cycles, lowers import input cost pressures and boosts MMF sector’s competitiveness.