Sanathan Textiles Limited, one of India’s integrated and diversified yarn manufacturers with operations across three yarn segments – Polyester Filament Yarns, Cotton Yarns & Yarns for Technical Textiles, announced its unaudited financial results for quarter and nine months ended December 31, 2025.

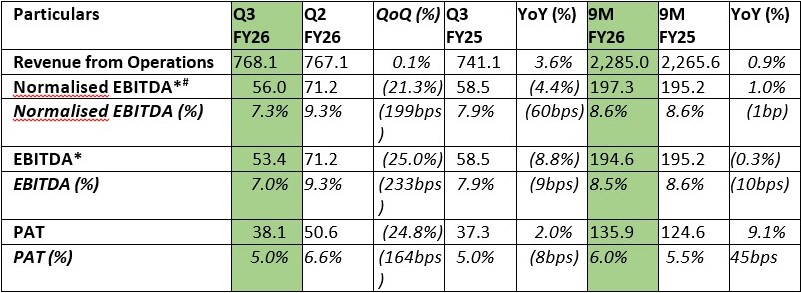

Key Standalone Financial Highlights (Rs. in Cr.):

*EBITDA is calculated excluding Other Income; #Normalised EBITDA is adjusted for the one-time impact of increase in employee costs on account of the new labour codes, amounting to c.Rs. 2.6 Cr.

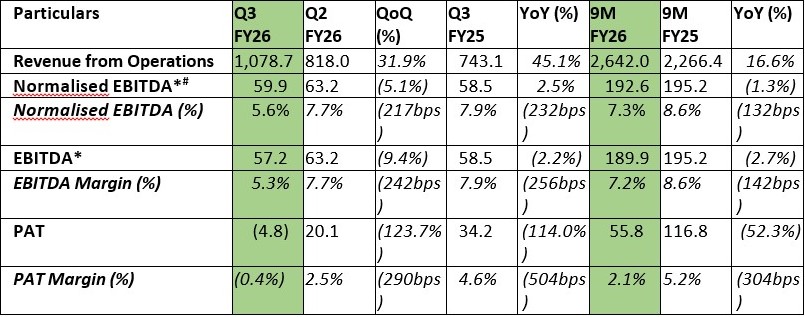

Key Consolidated Financial Highlights (Rs. Cr.):

*EBITDA is calculated excluding Other Income; #Normalised EBITDA is adjusted for the one-time impact of increase in employee costs on account of the new labour codes, amounting to c.Rs. 2.7 Cr.

Commenting on the performance, Mr. Paresh Dattani, Chairman and Managing Director, Sanathan Textiles Limited, stated:

“Sanathan Textiles maintained consistent operational performance inspite of a challenging quarter for the industry . While the US tariff affected demand for textile products, which in turn reduced our orders with some export-oriented customers in some end-use segments such as home textiles and apparels. We managed to maintain our Silvassa plant at optimal capacity utilization and generated stable revenues. Apart from the US tariff that affected the export demand, change in the GST rate (from 12% to 5% on fabrics) led to brief inventory build-up and stock loss as customers delayed their purchases to avail the benefit of new rate and this followed by the sudden removal of BIS/QCO on textile products in November creating temporary margin pressure for the entire value chain. During the quarter, we incurred certain one-time costs associated with: (1) Additional gratuity liability on account of the new labour codes amounting to c.Rs. 2.7 Cr, and (2) Capacity scale-up at Punjab amounting to c.Rs. 3.5 Cr (vs. c.Rs. 11 Cr in 2Q FY26). Inspite of the volatile scenario, we were able to Fully utilize the installed capacity at our Silvassa facility by pivoting to domestic placement of material which underscores our execution capabilities and ability to navigate evolving regulatory landscapes. Our Punjab facility continued its scale-up in Q3. Started commissioning at 350 MTPD, capacity increased by 25% during Q3 FY26 to 450 MTPD. The incremental volumes were effectively absorbed by the North India textile market without any inventory build-up, and this scale-up resulted in the Punjab facility achieving EBITDA positive for the quarter. The ramp-up remains on track, with current production at 575 MTPD, and Phase I polymerisation capacity of 700 MTPD expected to be achieved by the end of Q4 FY26.

The challenges faced in Q3 are largely behind us, and recent developments have turned sentiment positive for the textile industry. The settlement of the India–US tariff issue is expected to revive export demand and enhance India’s competitiveness versus other supplier countries. In addition, the new India–EU trade agreement opens opportunities across fashion-led consumption as well as value-added technical and automotive textile segments. The reduction in GST rates on fabrics is likely to support demand in the coming months, while the Union Budget 2026 provides a reassuring outlook for the sector’s growth.

The revision in tariffs and recent trade agreements are expected to open new avenues for technical textiles, further reinforced by the Government of India in the Union Budget 2026. This favourable backdrop aligns well with our strategy to expand the technical textile yarn division. We have progressed with the expansion of our technical textile yarn operations at Silvassa, which will double capacity from 9,000 MTPA to 18,000 MTPA by Q1 FY27, strengthening our presence in technical textiles and supporting long-term profitability. In line with our growth roadmap, we are also advancing the expansion of our cotton division in Madhya Pradesh, leveraging the state’s favourable cotton textile ecosystem. Following the achievement of full Phase I capacity at our Punjab facility by the end of Q4 FY26, we intend to move towards execution of Phase II, enhancing polymerisation capacity from 700 MTPD to 950 MTPD.

Looking ahead, with disciplined execution and a focus on operational excellence, we are committed to achieve our strategic objectives and create sustainable value for all our stakeholders. With our integrated operations and diversified portfolio, Sanathan Textiles Limited continues to build on its strong foundation to capture emerging opportunities in textile markets of India and around the world.”