Is the spinning sector, created out of the government’s incentives, gradually withering away? Looks like, judging from the current State of play of the industry. It has been dogged by excess capacity due to low demand at home and abroad, especially from China. Exports have shrunk to an alarming level in the first quarter of 2017-18. Worse, many spinning units have turned non-performing assets (NPAs) with more to follow, if the present situation, continues, due to stringent RBI norms on (NPAs).

What with the sharp fall in demand for yarn in China, our yarn exports have suffered due to disadvantage created by Free Trade Agreements (FTAs) of our competitors with big buying nations. And as usual, we are unable to cut ice anywhere. There is a feeling in the government that yarn exports need not require any incentives.

It was because of this belief or not the government removed the two per cent Merchandise India Exports from India Scheme (MEIS) and three per cent Interest Equalisation Scheme (IFS) to cotton, yarn exports while unveiling the new Foreign Trade Policy two or three years ago. Both these incentives need to be brought back so that exports do not suffer further. Total T and C exports have been stagnating at around $16 to $17 bn during the last few years. It is also known that exports also suffer due to high import tariffs in the importing countries, preferential trade agreements with the European Union and the US, better tax systems in textile competing countries.

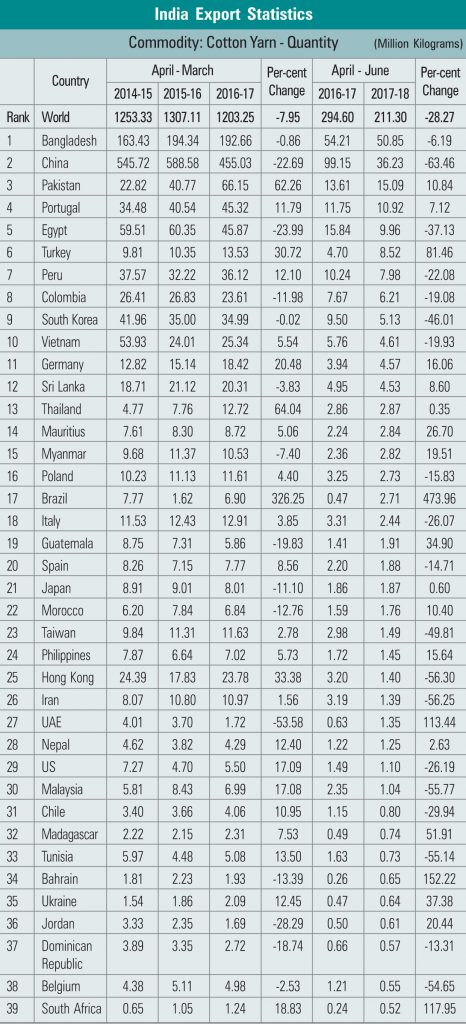

Cotton yarn exports declined by 7.95 per cent in 2016-17 and by an alarming 28.27 per cent in the first quarter of 2017-18 (April-June) as per the latest data available. These exports were valued at $6,726 mn in 2013-14. Imports of yarn however, rose by 89 per cent to $1,132 mn, mainly due to increased volume of cotton imports. Exports of cotton yarn and its products were valued at $6,637 mn, down 9.24 per cent from the previous year’s $7,313 mn.

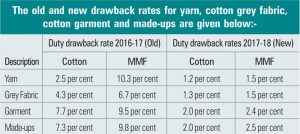

For cotton yarn exports, the old duty drawback rate of 2.5 per cent should be restored at least till March 31, 2018. The interim period could be used to sort out GST-related issues and calculate new rates after taking into account all embedded taxes.

The recent announcement of drawback rates came as a big disappointment to the T and C industry. “It is a severe blow to the industry which already needs under several critical issues for its survival,” said CITI in a statement. The T and C industry’s working capital has been adversely affected because of the inordinate delay in GST refunds to exporters who had shipped their consignments in July this year. Moreover, last year’s announcement of a special package for garments and included made-ups, granting enhanced drawback rates and refund of state levies (ROSL) does not synchronize with the present announcement on drawback rates, CITI further stated.

It is known that the T and C sector had been enjoying the exemption route, drawback and other export benefits which helped it gain a competitive edge over its competitors. However countries like Bangladesh, Vietnam, and Cambodia etc. have achieved a significant growth in garment exports during the last four years while India’s exports have stagnated.

As per the new announcement drawback rates has been pegged at 1.2 per cent for cotton yarn, 1.5 per cent for MMF yarn, 1.3 per cent of grey fabric, 1.5 per cent for cotton garments, 2.4 per cent for MMF garments and 2 per cent for cotton made-ups and 2.5 per cent for MMF made-ups. But in order to prevent any further fall in T and C exports, the drawback rate for yarn should be fixed at 2 to 2.5 per cent, at 3 per cent for grey fabric and at more than 5 per cent for finished fabrics, garments and madeups, going by CITI’s suggestions.

There was a limited growth in the spinning sector in the last five years compared to the preceding 5 years owing to reduced domestic demand and yarn exports during the last three years. During 2007-2012, the addition in the non-SSI spinning sector was 7.70 mn spindles, while it was only 3.81 mn spindles in the last 5 years.

Spinning is a capital intensive industry and is very important for the value added industry to develop and thrive. Currently, the country has 52.45 mn spindles and 8.76 lakh rotors spinning capacity. There is a 30 per cent excess capacity of cotton yarn for exports and the low demand in the global market has forced large number of mills to cut back on production, as stated earlier.

Another area of great concern for the textile industry is the challenges faced by the fabric sector, which suffers from high cost due to exogenous factors on which manufacturers have no control. The high incidence of blocked/embedded taxes /levies/surcharge etc. of about 5.33 per cent embedded in export consignments are not refunded at any stage. It is a big bottleneck that needs to be taken into consideration which resolving issues facing the sector.

In this regard, CITI has referred to China, which grants a 17 per cent rebate on exports, and implied subsidy to its fabric industry of 8 to 10 per cent. Bangladesh gives a 5 per cent subsidy to garment exports if fabric used is made from yarn sourced locally to promote the domestic textile value chain. Indian fabric producers also suffer from high transaction cost. Further, interest cost is much higher compared to China. Hence CITI recommends that fabrics be included in the ROSL package and provided with a 5 per ROSL rate for a period of 5 to 7 years.

The textile sector is at a very important threshold from where it can move to a higher orbit of growth. It is well poised to create a stronger footprint across the globe and more importantly meet the country’s inclusive growth objective of providing employment to the rural women. China which controls 35 per cent of global textile trade is in the process of vacating space due to its high cost structure and no one is better placed than India to grab the opportunity in the past. There was a lot of hope from within and outside India after toweliberalised in the early 90s and the industry learned to live without protection. Rest of Asia overtook as when we were growing.