India’s performance on the textile exports front is very encouraging. Apparel the most important item in the country’s export basket, has posted a whopping increase of nearly 60 percent during the first seven months of this year (January – July 2022) over the same period last year, as per the latest data available with the US department of textiles. What is more, India has overtaken China in respect of export. A further notable development is that India’s apparel exports have been higher than the total exports by all countries to the US. The outlook for the remainder of 2022 should be promising.

India’s performance on the textile exports front is very encouraging. Apparel the most important item in the country’s export basket, has posted a whopping increase of nearly 60 percent during the first seven months of this year (January – July 2022) over the same period last year, as per the latest data available with the US department of textiles. What is more, India has overtaken China in respect of export. A further notable development is that India’s apparel exports have been higher than the total exports by all countries to the US. The outlook for the remainder of 2022 should be promising.

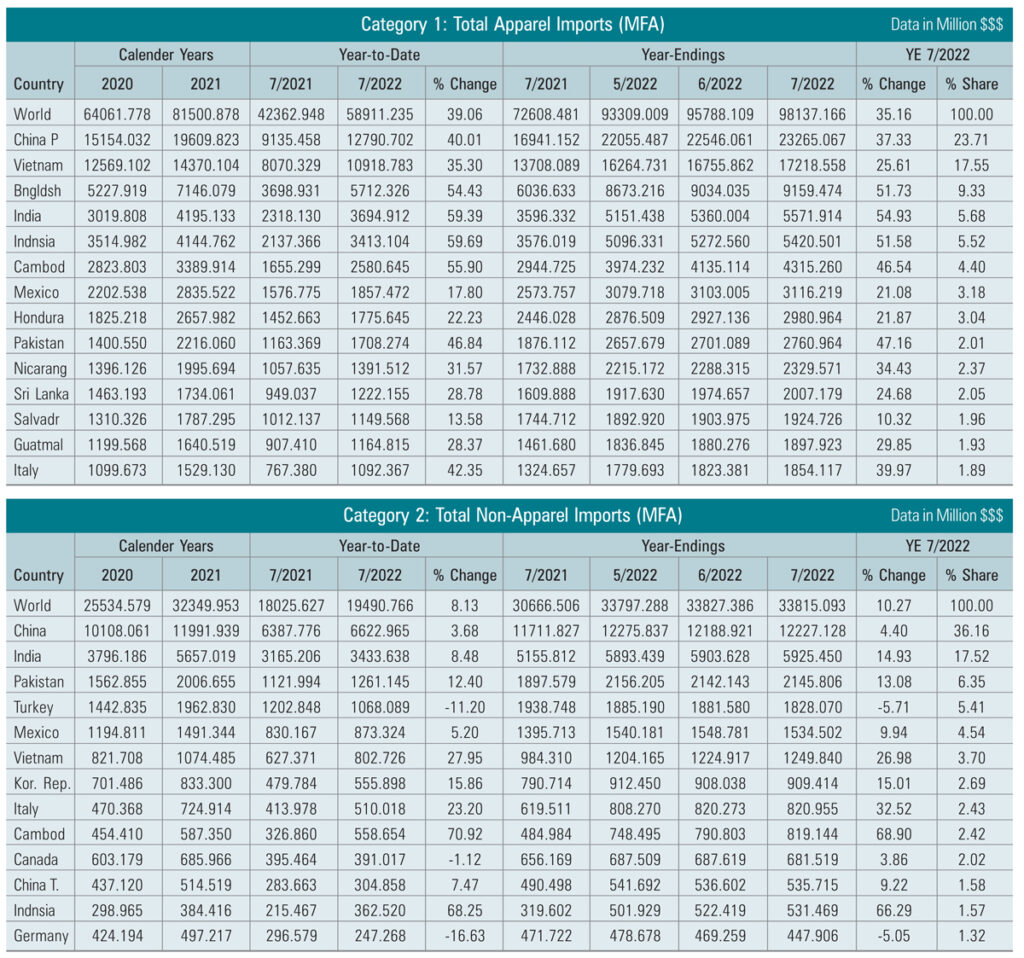

The data show that India’s apparel exports have risen from dollar 2318 mn to dollar 3694 mn during the period under review. On the other hand, China’s exports have shown an increase of 40 percent, from dollar 9135 mn to dollar 12790 mn. Vietnam, with a better infrastructure, has recorded a 35.30 percent growth, from dollar 8070 mn to dollar 10978 mn.

It is also to be noted that based on the data, India’s apparel exports are more than those of Mexico and Honduras both of which are covered by North American Free Trade Agreement (NAFTA) where they qualify for duty-free entry in US. Earlier they had been enjoying quota free status which was terminated in 2005 after the expiry of the WTO Agreement on Textiles and Clothing (ATC). The data show that exports from Mexico and Honduras were up by only 17.80 percent and 22.23 percent respectively.

As regards non-apparel, which consists of yarn fabrics and madeups, India’s exports grew by 9.48 percent, overtaking again China’s 3.68 percent increase. Vietnam recorded a 27.95 percent increase. Here again, India’s export growth surpassed world export in increase of 8.13 percent. Bangladesh notched up a nearly 20 percent growth during the period under review.

Before the quotas were removed through ATC by 2004, global trade in textiles and clothing had been governed by the Multi-Fibre Arrangement (MFA) from 1774 – 1994. WTO came into being on January 1, 1995.

It needs no mention that the US again is an important destination for India’s textiles and clothing exports. India is the third largest supplier of apparel and textiles products to the US after China and Vietnam.

A study by FICCI and Wazir Advisers reveal that India’s FTA with the US will majorly improve its share in the US’s apparel imports. From a value of 5-8 percent, it could increase as high as 20 percent by 2025. India’s share in US’s imports of textiles will also increase substantially in segments of MMF yarns and fabrics.

Amid demands from India for restoration of the benefits under the US’s Generalised System of Preferences (GSP) that allowed levy of lower import duty on several products, the withdrawal had not significantly impacted shipments from India.

During the first trade policy forum meeting in New Delhi recently, the US side was responsive to providing preferential access for Indian goods under the GSP as and when legislation is in place as reported in these columns. This move will help corner some of the space vacated by Chinese products. The Indian side was lad by Commerce Minister Piyush Goyal and the American side by its Trade Representative Katharine Tai. The talks are aimed at finalising a trade deal.

The US indication of giving preferential access under GSP may not affect Indian textile items, for 99 percent of the products are not covered by GSP. The remaining one percent coverage have most favoured nation (MFN) duties (normal duties) of 2-3 percent. An analysis of the situation by the Federation of Indian Export Organisations (FIEO) reveals that the duty advantage under GSP is on 5111 items out of 18770 tariff lines. For 2110 items the advantage is 4 percent or less. Exports with over 3 percent duty preference are likely to be affected. India was the single largest beneficiary of US GSP allowing it to export dollar 5.7 billion worth of duty free goods in 2 017, according to data available from US congress. Piyush Goyal feels that the US’s decision of withdrawing GSP benefits “is not exactly as per the norms of WTO and GATT which have been mutually agreed to and which are multilateral agreement”.

During the Trade Policy Forum meeting, it became clear that the relationship between two countries should not be “transactional” but should be based on “trust and understanding”. The meeting come in the backdrop of PM Narendra Modi and American President Joe Biden’s decision to “Develop an ambitions shared vision for the future of trade relationship. As reported in these columns the US and EU are the largest markets for textiles and apparel with a share of 14 percent and 36 percent respectively. The FICCI strictly says that the textiles industry has witnessed a major shift in the last three decades in terms of production base. Till the 1980’s production of textiles and apparel was centered in the US and EU. But over a period of time, production of these products shifted majorly to Asian countries. This was largely due to an attractive low cost manufacturing advantages in these developing countries.

Finding production of textile items becoming unprofitable for manufacture due to rising costs, the US and EU sought alterative destinations. Asian countries, with availability of abundant cheap manpower, vast natural resources and favourable economic policies were the most attractive destination for manufacturing textile products.

The shift meant maximum gains for China. Following the liberalisation of China’s Industrial Policy it became the hub of manufacturing textile for over this period, China emerged as the biggest manufacturing base for textiles, worldwide and had remained the largest exporter of textiles and apparel, maintaining as dominant share of 40 percent since 2000. Other Asian countries such as India, Bangladesh, Indonesia, Pakistan, Cambodia, Vietnam and Thailand also experienced an upsurge in their textiles manufacturing during this period. Currently the US and Europe have become the largest consumption bases in the world, while manufacturing is concentrated in Asian countries such as China and India (largest consumption bases as well), Bangladesh, Sri Lanka, Pakistan etc.,

The global apparel and textiles worldwide stood at dollar 820 billion in 2014, growing at compounded aggregate growth rate (GAGR) of 5.6 percent over last decade. Apparel categories had a large share of 56 percent, while the remaining had a share of 44 percent. Over the next decade, the global apparel and textiles worldwide is set to reach dollar 1600 billion by 2025, growing by a CAGR of 6.3 percent. The US and EU with a large growing domestic demand, coupled with spending power of people, will lead to a combined addition of around dollar 580 billion in the global market by 2025.