The textiles and clothing industry is on the throes of a major crisis. This development is rather unprecedented, adversely affecting the micro, small and medium enterprises in Tamil Nadu. There are about 20,000 garment units in and around Tirupur District in the State. There is underutilization of capacity due to drying up of orders from Europe. These orders have gone to India’s competitors.

The textiles and clothing industry is on the throes of a major crisis. This development is rather unprecedented, adversely affecting the micro, small and medium enterprises in Tamil Nadu. There are about 20,000 garment units in and around Tirupur District in the State. There is underutilization of capacity due to drying up of orders from Europe. These orders have gone to India’s competitors.

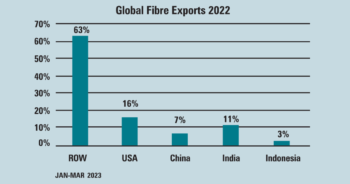

Bangladesh, for instance, has grabbed nearly fifty percent or more of these orders. Most buyers in Europe have postponed their purchases. The United States is also under recession and therefore fresh orders are not coming forth. According to President of the Tirupur Exporters Association, Raja Shanmugam, the development has hit exports from the region which may be about twenty to thirty percent lower than last year’s Rs. 32,000 to Rs.34,000 crore.

To save the industry from the crisis a moratorium on the loans given under the Emergency Credit Line Guarantee Scheme (ECLGS) may be extended by one more year. “Existing loans under ECLGS may be restructured, converting them into six year old loans. Fresh loans may be provided under ECLGS, reducing the regular bank interest rate, Tamil Nadu Chief Minister has said in a letter to Prime Minister Narendra Modi.

The letter said that the spinning sector with 1500 mills employing 15 lakh workers is one of the vital engines of Tamil Nadu’s industrial economy. The combination of high bank interest rates, coupled with poor domestic and international demand has plunged the textiles sector into turmoil. Due to this, the spinning mills had halted production for two days and resumed operations later.

Stalin said the Centre had provided short term loans to rehabilitate MSME units under ECLGS in the post pandemic period. “The repayment of loans has started which has become an additional burden on spinning mills. The other significant price differentiation between India and global competitors is the eleven per cent import duty imposed in India.”

Besides extending the moratorium on the loans, Stalin said withdrawing the 11 percent levy could reduce costs significantly. A temporary ban on export of waste cotton would help the industry tide over shortage faced by open ended spinning mills. “These measures will go a long way in bringing back employment in the spinning mills sector” he added.

Raja Shanmugam is also in agreement with Stalin on the loan repayment issue to save MSMES from the present crisis. Repayment of loan taken during the COVID-19 pandemic also needs to be addressed and given serious consideration say sources, in the Southern India Mills Association (SIMA). Unless the loan issue is resolved, dozens of mills may become non productive assets (NPAs). These sources strongly maintain that import duty coupled with the decision to tighten quality control on some manmade fibre imports have almost destroyed the textiles industry.

The import duty on cotton has led to a rise in domestic prices of the fibre by fifteen percent. This in turn has raised the production cost by Rs. 5 to Rs. 6 per kg. Due to the import levy India has lost money on international orders and is unable to compete with neighbouring countries in the export of yarn, fabric and cloth. In addition banks interest rates have gradually risen over the years from 7.5 percent to 11 percent. The Tamil Nadu electricity generation and distribution corporation (TANGEDCO) has increased the retail tariff for low tension petition and high tension consumers, multiyear tariff and tariff during peak hours raising the production cost of spinning mills.

A few days back spinning mills in Tamil Nadu decided to cut back on production but resumed their operations after an assurance from the State Electricity Minister. They felt that the import duty on cotton should be removed to ease the hike in cotton and yarn prices. They also want a temporary ban on export of cotton waste used by open end spinning mills in and around Coimbatore. The increase in power tariff has also become an additional burden. Besides, the spinners have urged the Central Government to grant duty drawback benefits for cotton yarn exports withdrawn on April 23 and restore the benefits under the Duty Exemption Passports (DEPB) scheme be restored.

Joining hands with the spinners association, SIMA Chairman J.Tusidharan says he does not want any restrictions on yarn exports in future, so that mills can start winning the confidence of buyers which will now take a long time since the damage has already been done and buyers have gone in for alternative sources.

There is an excise duty on garments, which the spinners want the government to withdraw to perk up consumer demand till GST is introduced and provide a two per cent interest subvention suggests Mukund Choudhury, President, Northern India Textile Mills Association (NITMA).

Chairman, Cotton Textiles Export Promotion Council Amit Raperha says that textile mills hold stocks of 500 million kgs which has completely eaten into their working capital. So they are finding it difficult to buy cotton and this has resulted in a decline in cotton prices in the market. This is no indication of adequate availability.

Three apparel associations- AEPC, TEA and CHAI – aver that the unprecedented increase in yarn prices and corresponding increase in fabric prices in a one year period was not due to increase in demand but due to speculation and hoarding in both cotton and yarn. The industry suffered as it was unable to pass on the increase to final customers due to price resistance.

Going by the replacement cost pricing policy adopted by spinners last year the current yarn prices are reflective of the steep fall in cotton prices. Most mills however had purchased cotton at much higher prices and hence crisis. The industry sympathizes with the plight of spinning mills and their call for removal of excise duty on domestic garments and for solving Tirupur dyeing problems. A positive resolution of these problems will definitely lead to increase in demand, which is almost eighty percent of the total yarn production.

It is to be noted that for the first time in the last two decades exports of cotton yarn and textiles have been declining by around twenty eight percent. At present cotton price per candy (365 kg) is Rs. 58,000, price of 40’s yarn is Rs. 235 per kg and clean cotton cost is Rs. 194 per kg according to a joint statement issued by Jagadish Chandran, Honorary Secretary South India Spinners Association (SISPA) and G.Subramoniam, President, India Spinning Owners Association (ISMA), both based in Coimbatore.

These two associations have appealed to Central Government to withdraw forthwith the import duty levy and reduce banks interest rates to the previous level of 7.5 percent. There is an unrestricted import of yarn and fabrics from neighbouring countries like like China, Vietnam, and Bangladesh. This has adversely affected the entire textile value chain. There is sufficient spinning capacity in the country, so no subsidy on concession is called for to increase the capacity.

The associations want the minimum support price (MSP) to be extended to cotton yarn, with the rate at least Rs. 2.25 per count per kg. From January, onwards all types of fabrics manufactured domestically should print the precise weight on the fabric.

At present TANGEDO charges 90 percent of maximum demand charges (MDC) or recorded demand, whichever is higher. Considering the extraordinary situation of the spinning industry, the Associations have requested the Tamil Nadu government to direct TANGEDO to collect 20 percent MDC’s or recorded demand.