Textiles sector is one of the oldest industries in Indian economy dating back several centuries. Even today, textiles sector is one of the largest contributors to India’s exports with approximately 13 per cent of total exports. The textiles industry is also labour intensive and is one of the largest employers. The textile industry has two broad segments. First, the unorganised sector consists of handloom, handicrafts and sericulture, which are operated on a small scale and through traditional tools and methods. The second is the organised sector consisting of spinning, apparel and garments segment which apply modern machinery and techniques such as economies of scale.

The Indian textiles industry is extremely varied, with the hand-spun and handwoven textiles sectors at one end of the spectrum, while the capital intensive sophisticated mills sector at the other end of the spectrum. The decentralised power looms/ hosiery and knitting sector form the largest component of the textiles sector. The close linkage of the textile industry to agriculture (for raw materials such as cotton) and the ancient culture and traditions of the country in terms of textiles make the Indian textiles sector unique in comparison to the industries of other countries. The industry has the capacity to produce a wide variety of products suitable to different market segments, both within India and across the world.

The industry is currently estimated at around $120 bn, is expected to reach $230 bn by 2020. The year 2017 turned out to be a mixed bag for the textiles sector. The two historical reforms last year, viz., demonetization and GST implementation had a huge impact on the performance of the Indian apparel and textile industry during 2017 due to various teething problems, delay in announcing appropriate export incentives, inverted duty, delay in refunding the accumulated Input tax credit, resistance from certain textile clusters, etc.

At the beginning of the year, exports began on a positive note, but was badly hit due to the uncertainties caused by GST. Today, minimal use of modern technology, lack of productivity, and too narrow a product base combined with a limited market exposure are the export segment’s biggest weaknesses. Unless these are addressed, we are likely to see a 2 per cent to 5 per cent growth rate at best. The domestic sector can look forward to a better run – with demonetisation blues a thing of the past, and GST issues gradually settling down. The value formats and brands though are showing a much better performance than the high priced brands and departmental store formats.

India’s apparel exports declined 39 per cent in value terms in October. Though the government did revert to the pre GST regime till end of October, the uncertainty could not be fully addressed, and resulted in an overall flat performance for the year. The domestic sector was of course hit by a double whammy of the post demonetization effect as well as the GST impact. The industry seems to have maintained its top line numbers by heavy discounting and early end of season sales, but margins have been badly hit.

A comprehensive national policy covering all segments of the textiles sector is the need of the hour, to give a push to exports from the sector, which have remained stagnant for the past four fiscal years, mainly because of less demand in major markets such as the US, the EU and China, and stiff competition from countries like Vietnam and Bangladesh which enjoy an edge over India.

Hence, the textile and clothing industry has lot of expectation and have sought tax and labour reforms by the Government in Union Budget 2018-19. A comprehensive national policy covering all segments of the textiles industry can give a push to exports. The government should urgently review the Duty Drawback rates and other issues impacting the export sector. If this is not done, this is quickly going to be a nonviable segment. As far as the domestic sector is concerned, it is important for the government to ensure that the current GST rates are maintained, and if there is a rethink on the number of slabs, apparel is kept at the lowest slab. Otherwise the gains made by having a uniform rate across the industry will be lost.

The year 2018 may turn out to be a challenging year for India’s textile and garment industry, with exporters still reeling under the impact of GST and outward shipments likely to miss the $45 bn target for 2017-18. Garment exporters have sought that the duty reimbursement to them should be retained at the pre-GST drawback rates of 7.5 per cent, amid declining exports.Currently, the drawback rates are 2-2.5 per cent.

Meanwhile, some initiatives were unveiled for powerloom units and weavers, the much-awaited new National Textiles Policy is yet to see the light of the day. Towards the end of the year, a Scheme for Capacity Building in textile sector to boost skill development and job creation was launched with an outlay of Rs. 1,300 cr. Around 10 lakh people are expected to be skilled and certified in various segments of textile sector.

Further, an interest equalization of 3 per cent in respect of yarn exports in order to make domestic product competitive in international market for boosting yarn exports. The industry also sought exemption from payment of GST on exports, reduction in GST rates from 18 per cent to 12 per cent on manmade fibre and sufficient provision for Technology Upgradation Fund Scheme in Union Budget 2018-19.

Besides, 2017 was a not a good year for spinning industry in general due to poor demand in both domestic and export market and relatively high cotton prices. 2018 will surely be better, however industry doesn’t expect it to be much better and the industry on the average may just break even as cotton prices are ruling high. The government has given cotton yarn a step motherly treatment since 2014 due to which the industry is in a big trouble and facing a lot of NPAs. The industry needs MEIS & IES plus ROSL which is being given to other segments of the industry so that it can compete at par in the international market till the domestic market consumption picks up in a couple of years to consume the surplus yarn capacity.

Besides, 2017 was a not a good year for spinning industry in general due to poor demand in both domestic and export market and relatively high cotton prices. 2018 will surely be better, however industry doesn’t expect it to be much better and the industry on the average may just break even as cotton prices are ruling high. The government has given cotton yarn a step motherly treatment since 2014 due to which the industry is in a big trouble and facing a lot of NPAs. The industry needs MEIS & IES plus ROSL which is being given to other segments of the industry so that it can compete at par in the international market till the domestic market consumption picks up in a couple of years to consume the surplus yarn capacity.

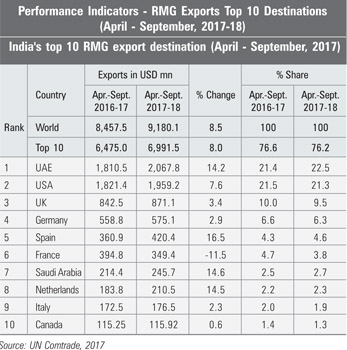

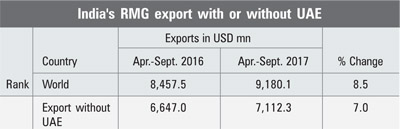

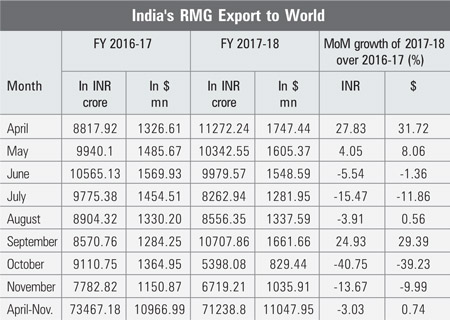

India’s Ready Made Garment (RMG) Export Update for FY (April-November) 2017-18

- RMG exports were to the tune of $1,035.91 mn in November 2017 recoding a decline of 9.99 per cent against the corresponding month of November 2016

- In rupee term export for the Month of November 2017 was Rs. 6719.21 cr. as against Rs. 7782.82 cr. in November 2016 with the decline of 13.67 per cent

- India’s RMG export to World in the April-November of 2017-18 was to the tune of $11047.95 mn which has increased by 0.74 per cent compared to the same period of previous financial year. During April-November 2016-17, India’s apparel exports were to the tune of $10,966.99 mn

YC Gupta Indorama Industries Limited

The year 2017 was not a good year economically. The GDP is going down, due to demonetisation and implementation of GST. The production, as well as demand, has gone down and there is a big pressure on prices, in every area of activity. The overall business has gone down, due to reduced manufacturing activities which were hampered, by above decisions. It YC Gupta Indorama Industries Limited looks that year 2018 may do little better then 2017, for various reasons.

It seems that India is producing fairly good quality of various types of cotton, manmade and blended yarns, however, Indian quality is just considered as an average quality, as compared to Indonesia, where they are producing more value added yarns and commanding premiums by using contamination free cotton. Indian yarn industry is still reluctant to do it and hence globally Indonesian yarns are commanding premium over Indian yarns. It is merely a will power, which has to be improved.

After demonisation, of the old notes, the trade and business have converted their old currency, into new currency, by adopting various methods. Actually they play very important role in the whole supply chain system of trade and manufacturing. The activities in parallel economy have been greatly adversely affected, due to implementation of GST. No doubt that the implementation of GST was required and is a great job done by the govt. with lot of will power. It was certainly required, to give right direction, to the trade and industry, for giving proper shape to the Indian economy.

Unfortunately, the parallel economy is almost as big, as fair business economy and due to GST implementation, a major amount of money has gone out of circulation. This is what is affecting the business activity levels after implementation of GST. Although, the govt. had given an opportunity to traders and business people to declare their non-taxed income, before demonetization, but the amount declared under this scheme was not commensurate, to the total amount, being used in this type of trade and business.

It looks that still untaxed amount of money is huge which is lying unused and has gone out of circulation. Now, although it looks to be very difficult for the govt., to take any decision, for giving last opportunity to trade and commerce, to declare untaxed income with a very reasonable rate of tax including penalty. It seems evident that having no more choice, all such people will come forward to declare the undisclosed income by paying tax to the govt. It will be a win win situation for both trade and the govt, by which the entire undisclosed money will come in to circulation and certainly the GDP will be increased with lot of job generation.

It is a hard decision to be taken. Apart from this, the govt must give more and more subsidy and incentives to garment manufacturing industry, where we are lagging far behind, from even Bangladesh and Pakistan. Garment manufacturing, will certainly create enormous number of jobs, with much lesser investment in the textile industry.

Sanjay K Jain TT Ltd

2017 was a Black Year for spinning industry in general due to poor demand in both domestic and export market and relatively high cotton prices. 2018 will surely be better, however don’t expect it to be much better and the industry on the average may just break even as cotton prices are ruling high.

India is one of the most efficient spinners in the world, our problem is high power cost and relatively high cotton costs at the end of the season plus over capacity in the system. We have 10 per cent excess capacity in the country which is struggling to find a market after China reduced buying from India and shifted to Vietnam.

The government has given cotton yarn a step motherly treatment since 2014 due to which the industry is in a big trouble and facing a lot of NPAs. The industry needs MEIS & IES plus ROSL which is being given to other segments of the industry so that it can compete at par in the international market till the domestic market consumption picks up in a couple of years to consume the surplus yarn capacity.

Pankaj Bhardwaj Nahar Industrial Enterprises Ltd

Last year, after GST it was completely a challenging year for the entire textile supply chain. But now spinning mills are slowly coming out of this situation and looking forward to a bright 2018. For us as a company it was also a challenging year but we came out great due to change in our product mix and by focusing on the markets which are less affected. We keep on doing R&D and also upgrading our technologies on regular basis to stay ahead in the market.

I think the govt. needs to be friendlier to entire textile industry. They usually focus more on garmenting sector instead of complete textile supply chain from fibre to garmenting. Textile industry is so vast like railways giving employment to large no. of people and generating huge revenues for the country. So, all the segments should be equally treated in totality when it comes to textiles. They should also try and learn from the other countries like what they are doing to become stronger than this in global arena.

Shalin Shah Jitendra Kumar Lalbhai & Co.

The introduction of GST created new problems in an already ailing market. Yarn exports declined by 20 per cent & garment exports by 40 per cent mainly due to reduction in drawback rates & higher working capital requirements due to unavailability of GST refunds to exporters. Rupee also appreciated by 4.5 per cent from low of 67 to 64 hurting exports. Frequent changes in the policy Post-GST like GST reduction from 18 per cent to 5 per cent for job work, 18 per cent to 12 per cent on man-made fibres, etc. had also caused confusion, uncertainty & fear among local business community. Retail sales dropped by almost 50 per cent due to major trade being in unorganised sector.

From November 2017 we could see markets rebounding back in exports & domestic mainly due to hike in raw cotton prices. Raw cotton prices shot up by 13-14 per cent in last 2 months locally as well internationally. Yarn prices skyrocketed by atleast Rs. 5-20/kg during this period. 2018 looks promising as the unorganised sector is slowly getting organised & compliant although it is difficult to say how long will it still take to completely recover. Major concerns in 2018 are:

Inspite of hike in cotton & yarn prices, fabric prices have not made its way ahead comparatively due to which disparity prevails. Ideally GST should bring down the cost but there has been a reverse effect wherein cost has gone up. Effective implementation of GST is very important to bring down cost & be more competitive. Denim segment is the worst affected with massive investments at risk due to 40-50 per cent fall in capacity utilisation. Early revival of this segment is very important. Payment cycles have gone from bad to worst choking up entire supply-chain. It needs to be restored back else many companies may go bust.

Textile industry being highly capital & labour intensive, govt. should get into damage control mode & take quick action to clear hurdles like a) IGST refunds to exporters & manufacturers who had to pay IGST on import of machinery during the blackout period before EPCG scheme was brought back b) extend drawbacks / Incentives on textile exports till June 2018 to boost sales & manufacturing output c) Extend support through banks to cater additional working capital requirements of the industry to sustain the after-effects of GST.

Selva Sri Kalyan Export Private Ltd.

As you know one of the major events for most of the industries in 2017 is GST which turns almost all the industries in India. And special mention is textile industry where majorly the companies which done without billing and without accounting affected majorly. But for a company like us who operate as per government rules and norms have no issue to do business in Indian market and international market. We are always positive and try to do more business turnover than previous year and except atleast 3-5 per cent growth this accounting year. As we are catering to high compliance and high quality standard fabric requirement buyers we able to maintain and meet their requirements as we are Certified Woven Fabric Manufacturer with Oeko- Tex, GOTS, Fair Trade, OCS, SA-8000, BCI, ISO 9001:2015 etc., and these are ensured and audited by International Certifying Institutions. And we also very positive and look forward for 2018 and continue to be one of the most trusted woven fabric manufacturer and exporter whose quality, commitment and timely delivery will speak for Sri Kalyan Export Private Limited to get good business.

Indian is one of the major cotton textile manufacturing countries in the world. At present international market being cheap is not only considered to be competitive. Today, buyers are looking to do business in a sustainable and ethical way. So as our part we try to do business in more ethical way and follow fair trade practices and also providing living wages to workers, safe working place with all basic amenities and one of the most important is interest free loans to workers and employees in our company which is more beneficial for them in many ways. We also ensuring with our Fair Trade Certificate and Social Accountability International Certification SA-8000. So not only low cost will make you competitive in present international market above factors also decide it.

One main request to government from textile industry for many years is FTA with Europe. This will help to increase Indian textile exports by 25-30 per cent. As our major competitor countries all have FTA with Europe like Bangladesh, Sri Lanka, Vietnam etc. Indian has advantage of doing small volume orders so with FTA we are able to attract more European buyers. And government should form a committee to control cotton yarn price.

Sandeep Dahiya Malwa Industries Limited

2017 was a year full of challenges. Two big events one aftermath of demonetisation and second the introduction of GST was difficult for the industry to handle. Although organised sector is already fully compliant with banking and were already in tax net and compliant but the downstream customers and customer’s customer were from the unorganised sector and hit was big for them. The effect back tracked to all organised players resulting in huge finished goods stocks as well as reduced number of orders. Most of players are still struggling to run their plant at optimum capacities.

To be more completive globally, the organised textile industry has to more focus on export viability of the sector, the numbers may seem large if we see the textile exports in isolation, but if we compare what other countries like China, Pakistan and Bangladesh are doing, our export numbers are far behind our potential considering size of our industry. If we are more resilient than industry would be in better position to withstand temporary setbacks like DEMO or GST.

We look forward to the government to help the industry by 1) By simplifying the compliance processes in GST regime, 2) Timely reimbursements of Export benefits and other government dues. 3) Due to new taxation reforms and rupee appreciation our exports are becoming outpaced in world market. Government need to look at the numbers and help exporters by suitably recalibrating the export drawbacks and refund of some levies which are still out of GST net.

Mahesh Maheshwari Nimbark Fashions Ltd.

The textile industry is fragmented and a large part of it is in unorganised sector. Because of this nature, the industry was hit most by demonetisation as well as introduction of GST in year 2017. The production levels were low and margins were also hit. By the end of 2017, there was some sign of recovery as international demand started picking up. The effect of demonetization reduced substantially, industry became familiar with GST and therefore the pickup in industry could be seen by end of 2017.This recovery is expected to continue for most part of 2018 and we are hopeful to see a good year ahead. The only spoiler could be rising crude prices which may impact raw material prices and therefore impact overall margins.

Most of the Indian Spinning Industry thrives on basic commodity products which gives them very thin margins. Any adverse rise in raw material or other cost put them in trouble. Also the capital expenditure is quite large as compare to turnover generated which increases risk if the value addition (margin are thin). The spinning industry has to think about adding value addition yarns in their product mix. This might be with various natural fibres or value addition at spinning or post spinning levels.

An overhaul policy initiative is required for rejuvenation of textile industry in India. This includes investment initiatives, labour policy as well as trade policy. Textile is 2nd largest industry as far as job creation in India is concern and therefore special attention should be given for the growth of this industry. There is large competition to Indian textile industry from most of the Asian countries and therefore a major trade incentive scheme should be put in place to boost export of textile products from India.

Vipin Madhukar KG Fabriks Limited

Indian textile industry, especially the weaving sector is not doing well, and infact 2017 was one of the worst years for the same. The decisions like demonetization and GST implementation hampered the growth of entire industry due to which 50 per cent of the same in is not operational today. Everyone had to cut down their production, and exports market orders have also reduced. Now, the govt. is thinking to revamp the industry but it won’t be possible so easily as the complete chain has got broken.

Small sectors and garmentors faced huge challenges and are utilizing only 25 per cent of their production capacity. From weavers to processors nobody is doing well. We don’t hope anything from the govt. and think their entire approach towards the industry is not good. After FDI small scale sector throughout the country will be badly affected, and same is with small and medium scale companies in our segment who are also going to face this. As far as our company is concerned, we increased our capacities before demonitisation and keep on doing the same along with technological upgradation to overcome this situation. But due to this govt.’s non industry friendly policies, from farmers to factory owners everyone is badly affected. GDP has also reduced and nothing seems to be improving in 2018.

Hari Mohan Kothari Kothari Hosiery Factory Pvt. Ltd.

Business is growing down dayby- day but cost effectiveness is not there in the Indian market. The cost part is a big problem for business houses to survive in the global market. We have to abide by the decisions the govt. is taking, but at the end they should also see that the industry is going under turmoil now, and try to promote and give some benefits & subsidies like what Bangladesh, China Governments are giving to their apparel exporters, which is the reason why they are able to survive and create foreign exchange for their country. Here we are trying to do our best but still cost effectiveness is not there. The subsidies, drawbacks and all the benefits have been withdrawn. After GST imposition cost has gone up by 5 per cent. The things are not favourable for the apparel industry, so I request the govt. to support us. As an exporter we are working on cost effectiveness, going for lean manufacturing and taking other initiatives, but simultaneously something have to be done by them to save this industry.

Anubhav Sadh Elegant Design

For last one year the market is stable; if it’s not going down, it’s also not even increasing. Definitely there is going to be a lot of burden on exporters after GST and reduction of our drawback. Today, a huge chunk of our capital is blocked in GST returns so we are facing a lot of problems. GST is more for retails or domestic sector and it doesn’t really apply on exporters. Maybe the govt. can put up drawback rates again like earlierand start giving us GST returns. To be competitive, the Indian exporters need to specialize in one product; exporters here do all kinds of products in all types of fabrics due to which they lack. In China if somebody is using polyester, they are only doing polyester, they expertise in that particular line so we have should also focus on one particular product or line to be more competitive. As far as 2018 is concerned, again itdepends on our PM what new policies he is going to decide for us. But overall business I would say is stable. We are not looking forward to any growth as we don’t think there is going to be any increase in our business next year as post GST our product prices have increased a lot. In fact, we don’t see anything where we can get the GST refunds soon.

Ayush Manglam Exports

Last year was good for us as we are growing much of our scale. Though in the second half of 2017 some orders got delayed due to GST implementation in markets like Surat but everything is getting smooth now. To boost this industry’s growth, the govt. should try and solve the GST refund and drawback issues soon.

2018 we are expecting hopefully to be better but our drawbacks are totally over and we have to ask more margins from the buyers. We cannot give competitive prices in comparison to China and other countries.

Rahul Abbot Rahul Natural Styles Pvt. Ltd.

GST and demonetization affect is still there in the market but yes slowly we are recovering. The major issue was drawback, which was lowered during last six months. Duty drawback is very important for apparel exporters but was reduced by seven per cent, which is a big hit to the industry.

Yes, we are recovering but it’s a big blow and we want the govt. to incentivize us to grow further. Govt. should support and help in boosting export fraternity’s growth and make us more competitive in South Asian market. We are very optimistic for 2018 and see it as good a year for our textile industry as a whole.

Anushruti Art & Craft Exclusive

Most of the companies in Jaipur had dull business last year. To be more competitive globally Indian apparel exporters need more exposure by participating in various shows worldwide. The more you have exposure, more you get to meet buyers overseas who are interested in your collection. From the govt. side I want this particular industry to be promoted in a better way. We work really hard to achieve certain results so need more exposure. Demonetization didn’t really affect us but GST is a major issue, as we have not started getting the refund.

Besides, labour problem is always there. We hope 2018 to be a promising year, as we have got a good feedback in the kids segment. We plan to enter into other areas also like accessories, made-ups etc. We are learning from our past mistakes and trying to make it more productive and fruitful for us.

Jitendra Sadh J.K. International

Being an exporter you have to be very hard working and strong to stay in this market. At present, dollar is slow, international market is dripping, GST with no refunds, the drawback is 7 per cent less so we have a direct impact of 12 per cent on our costing. What we could have sell at 12 per cent less, now we have to add 12 per cent more along with dollar value which is down 3 per cent, so overall cost of 15 per cent is added. Then business is also slow so you have financial crisis, also the flow of cash is not there so it’s really tough time for exporters. Once they had the GST implemented the govt. should have the mechanism ready as how the exporter will get the refund. At the moment, export industry is under severe problem. We always stay positive so are hopeful that things will improve in 2018. We hope in the upcoming budget govt. may end up with no GST on fabric for cloths because there’s a big market for this segment earning foreign exchange for the country.

Ajay Kumar Malik Vedanga Exports and Marketing P. Ltd.

In 2017, our export remained nearly the same like 2016 and doesn’t really change. Due to GST implementation there were some issues in industry but after two months it regained the momentum. Now, it’s going fine and scenario has become better. Govt. should support us in a better way so that our exporters become more completive and their order doesn’t shift to cheaper exports country like Bangladesh.

I am expecting that in 2018 foreign trade of India including apparel exports is going to increase. Even the Ministry of Textiles has targeted to increase apparel exports by 8-10 per cent per annum. So, looking at all this we expect a better future ahead. This year we are diversifying and will be entering jewelry and home décor segments also.

Ravi Bhushan Jain Renu Creation

Our production got reduced by almost 30 per cent after demonetization and GST. But now we have started growing again as season looks good in terms of orders hence we are optimistic about 2018. Govt.’s help is completely nil to the garment manufacturers, so we are making our own efforts to sustain in the market.

We belong to Ludhiana, we don’t even have a proper exhibition ground there to hold an international garment fair to get more business. If the govt. supports and provides us proper facilities, connectivity and policies, we will flourish like anything.

Vijay Singh Sengar Shilpayan Decor

Business was little bit slow last year but now it’s going to rise according to market and country which we are catering to. Our product range is very different from others because we do the very heavy embellishments and high fashion apparel so we are catering to particular market segment. It’s going to be taking atleast 2 years more for apparel export industry to be back on its growth track as we witnessed a lot of ups and downs in last one year.

We are expecting more from the govt. for betterment of this industry and we should all come together and sort out the issues which we are facing. Overall, we are expecting a very good future ahead.

Megha Dugar Export Warehouse

Previous year was really nice and went well for us. Yes, because of GST we had faced problems, but somehow we managed. We have seen everything but now its fine and have learnt dealing with it. However, it will be good for the apparel industry in long term.

The market is definitely going to improve in 2018 as in this market demand for our kind of work is increasing so it’s going to be good for our company.

S S Luthra Cotton Jersey

Looking at the market scenario I am planning to retire in 2018 which was supposed to happen after five years. When there is no govt. support, you can’t expect to do businesses. So we should do something where the govt. supports, why this business? In general term, there should be govt. support from each and every stage as right now there is no support at any level in terms labour, laws, GST implementation etc. In last one year garment prices have gone up by 10 per cent for not only for me but everyone. I lost nearly a million dollar business in last five months; we were not able to make a single piece of order because prices of the garment went up 10-12 per cent.

That is the maximum margin a person can think in this trade. We have shut down 50 per cent of business, and if the same thing prevails, by the time govt. improves something we will be out of business. We can’t do anything but will only have to wait and watch how it’s going to be in 2018.

Ramandeep Singh Boutique International

2017 was challenging and the 2018 is going to be worse as India has no advantage because of GST issues, rupee appreciation and no help coming from government. To be more completive globally, there is nothing that industry can do where basic request of the industry like clearing the GST hurdle, drawbacks rollback have not been heard.

This is clearly not a priority sector for the government. Seeing last six months experience, we don’t have any expectations from the govt. for further growth of this industry.

Gajendra Sharma Ganpati Fabrics (Krishna Exim Inc)

The market was little dull due to GST in 2017. Moreover, the govt. reduced duty drawback, is not issuing ROSL alongwith no GST refunds so all these are the major issues for apparel export industry. Infact banks have become stricter due to NPA which is bad for smaller exporters making it difficult for them to operate. After demonetization and GST implementation apparel exporters are facing huge problems.

Governments in countries like Vietnam, Sri Lanka, Cambodia, Bangladesh and China are supporting their apparel export industry a lot but here in India it is totally opposite. How will we compete against them when we are unable to fight? We need govt. support, atleast they should give us the GST refund as our working capital is blocked there.

Vijay Kumar Agarwal Creative Garments Pvt. Ltd.

First half of 2017 was better than next half-mostly because of withdrawal of drawback. 2018 is going to be very challenging. There are signs that lot of exporters are under financial stress and they may have to close down. As it stands today I see a very gloomy 2018 for this industry.

Right now the way industry is structured it is bound to doom/ fail. Our manufacturing facilities are concentrated in most expensive and costly cities of India where costs are only going to go higher. With global scenario it will be almost impossible to survive for long like this. It has become imperative that industry move to less costly areas of manufacturing. Skill development, innovation and enhancing efficiency is another challenge which industry has to overcome. On a positive, note Indian entrepreneurs are very flexible/ intelligent and I am sure they will find ways to overcome such obstacles.

As far as govt goes it is no rocket science to know that this industry is the highest employment generator. I don’t think they have any choice but to support and ensure that the apparel industry not only survives this immediate crisis but sustainably grow at a healthy rate. For that first of all they have to recognise this industry as a special category and ensure enough incentives are given in different forms to this industry to be competitive in the global market. Globally, many manufacturers like Bangladesh, Vietnam, Myanmar, Cambodia has been given special status by importing countries there by giving them advantage of duty free imports. To make India competitive Indian govt. We have to create a level playing field and ensure exporters are compensated suitably. If not done future of Indian apparel export industry looks quite gloomy.

Toshiaki Yamada Brother International (India) Pvt. Ltd

In India market we had many challenging issues in last one year like demonetization and GST. But as a whole, despite of such factors coming subsequently one after other, we are very confident. I cannot deny its impact on our customers and sales but now it’s stable as everyone is becoming used to it. The companies are surviving with more confidence due to their efficient management and they are getting more volume of orders. At the same time, exports segment is going tough but domestic market is constantly growing.

India has huge population and ladies fashion keeps on changing, so domestic apparel sector has a bright future ahead. Also the labour cost is going up so upgrading the technologies and going for automation will be good option for the apparel manufacturers. Our technologies are highly labour saving, and we can facilitate machines as per customers’ requirement in this market. Our customers will always get good support on buying a Brother machine. We are hopeful that 2018 is going to be a good year for us and customers.

Lucian Jack Sewing Machine Co., Ltd

Last year was very tough for other companies but for Jack, though business was a little affected for some time, but due to all our agents’ support and team work we captured the market very aggressively. In 2017 we achieved very good results in comparison to 2016 and increased a lot. At Jack we have different teams like Indian, South Asian, European, African, American etc. Out of these Indian team ranked no. one so the result in very good.

From January to October Indian team was chasing but in the last two months it picked up very fast and became no. one. Of course the issues like demonetization and GST affect us a little but due to our team support we recovered very soon. Our agents are very confident for 2018 because now more and more customers are asking for Jack. We are hoping to achieve bigger targets this year. We are also opening our office in Tirupur this year and have also appointed more local technicians to give technical support to our agents. Now, everything is ready from operation staff to decoration so the new office will start in February this year.

Peter Pan Kaulin Mfg. Co., Ltd. (Siruba)

Last year was tough not only for Siruba but all other brands in the Indian market. The Indian apparel industry for the first six months was affected by the demonetization impact and July onwards GST impact. As the customers didn’t know if the rules will change or not 2017 was really tough for Siruba. Like in 2009 due to global economic meltdown it was basically affected internally in India. Other markets globally were quite good for Siruba and this year scenario was more stable for us and our agents, so everybody is quite positive.

Like 2016, we feel the customers now are more active and positive for technological investment. India is actually very dynamic and very strong but we cannot restrain by this kind of factor, and still are very positive and moving slowly. I have been taking care of India market for last few years and the problems which occured last year were something I witnessed for the first time. With a support of our agent Mehala we certainly hope to do better in 2018.

Field Tian Zoje Sewing Machine Co. Ltd

We have appointed Magnum Resources as our agent and some dealers here in India so we are expecting to get good business in 2018. Our machine’s quality is stable; brand is there especially in Delhi and Mumbai. Everyone knows that our quality is good so we don’t need to worry about our quality and brand name here. GST was introduced last year and there was normal change in the market.

That is not a factor for sewing machine business in India because not only Zoje but every sewing machine company is facing this problem, so no big deal. As a foreign brand selling its machines in India we are facing a lot of challenges like many Chinese brands doing business here. But we have to focus on our own brand and strategise accordingly. In 2018 we are targeting to increase sales volume by four times. We are planning to open our new office in Noida or Okhla soon. Future is going to be good for apparel manufacturing and exporting industry in India.

Bernd Brauer Durkopp Adler AG

In terms of sales last year was good for our company in India. Ofcourse we are never satisfied, and there’s always room to grow. But in general the development was good, we have done good business development in all segments like garments, heavy duty segments like upholstery, automotive, and are satisfied with our growth here. I have been coming to India for last so many years, but have not witnessed many changes in terms of infrastructure and think a lot need to be done here. Ofcourse we are happy with changes in tax system i.e. GST, because India is now little bit more easy to do handle. It’s not a very complicated tax system like before, which makes our life little easier. It’s a positive development here in India, so surely we hope that with this govt. things are going forward. But infrastructure is somewhere they need to improve. Indian apparel industry was doing well, though for some time it became slow but again it has started moving and grabing good business from Indonesia, Vietnam and even from China. We as a company are getting good feedback from our agencies, so things are much better now. We are very positive about our future and are on way to open our office to support the agencies and customers, giving better service in this country.

John Tan Pegasus Sewing Machine Pte. Ltd.

We are coming up with more cost effective and optimisation machines for our customers. The market seems to be quite positive and expected to pick up very soon. As a company we were also affected by the problems like demonitisation and GST which occurred last year. Now the market is accepting it, govt. is also taking initiatives to help them get more business. To move India, which is a very big country, is not a small job, so it takes some time to make industry used to a major tax change that they have introduced. Otherwise as a company, a technology supplier from outside, we see situation has improved after GST. So, all the custom, cross border duties are not there anymore. I think in long run they will have to market it. In 2018 we would like to bring more technologies to the market because I think India is little behind in terms of accepting the technologies. This may be because of fear or discomfort that maybe the technical support will not be there. But they can’t run away because the technology which is coming to the market is going to their competitors. So, if they don’t catch up they will be left behind. I think some more efforts are required to introduce technologies here. Comparatively speaking, the market in Sri Lanka is little more ahead in terms of innovation and automation. India has the advantage of 1.2 bn people so no agency for automation as manpower is enough here. The market will improve and everything will get stabilised. Bernd Brauer.

Pavan Kapoor IIGM Pvt. Ltd.

It is now a well-established fact that technology will command a greater and more fundamental role in business. It really does not matter in which segment one is operating, whether in manufacturing, trading, service provider etc. The importance of technology for better quality, consistency, data collection and analytics is crucial for the survival of a business. Many companies have understood this Mantra and are pushing hard for adoption of modern technology, which to us is the real challenge.

2017 was a subdued year keeping in mind the after effects of demonetisation, resulting confusion due to implementation of GST and a weak dollar. It is commonly said in business that when confusion prevails, no one will take a risk to expand and everybody would adopt a wait and watch policy. 2017 has ended on a week note due to these reasons.

The biggest issue facing industry today is the implementation of GST. While the Government have been pro-active in understanding the concerns of the industry and have adopted the policy of differing compliance, there are still many loose ends which need to be sorted out quickly if the industry has to comply and prosper. One e.g. to prove this point is the operation of Bonded Ware Houses which has come to a virtual standstill after the clarification of Notification was issued in November 2017. This clarification sought to impose IGST on all Bonded Ware House supplies. Further, concessions to an EPCG Licence holder or EOUs also need to pay GST and claim refund thereafter. This has defeated from the basic purpose provided by Bonded Ware Houses to the export sector for its raw material and capital goods requirement on a just in time basis. Our understanding is that these matters are lying with GST Council as also the Courts; but delay in decisions can be very detrimental to the export industry at large.

Anil Anand HCA Group

Everybody is thinking of investing in new technologies. Nobody is having right cash at the moment but waiting for the right policies of the govt. Our PM is talking about improving everybody’s lifestyle but I think it cannot happen without the healthy support of garment industry. Because migration from agriculture to garment industry doesn’t take much time as it takes around 20 days to train a laborer to make a factory operator. Today, China has older labour force but India has1.4 bn people comprising young labour force so you have to tap them. You have to go to the areas where they come from, instead of moving them into cities, give them work in their home towns, and develop those areas. There I see excellent future.

But the govt. should make sure to create conducive atmosphere so that people start investing. Earlier none of the exporter wanted to migrate but now many of them are doing so. The unemployed people can be absorbed in garment sector. The govt. has to provide right infrastructure, labour laws, and also pay them the GST benefits what you promised.

The demonetization and GST had very big impact on apparel and textile industry but the govt. should fulfill their promises. 2018 looks very good, the year had begun very well which pushes us to work harder and to achieve what we have not achieved till now. Time is right, the ingredients are there the only the right temperature has to be given by the govt. so that we have good food coming in.

Last year as a company we didn’t have much growth maybe it was around 5-7 per cent. I don’t expect this growth at this stage and think the work should double in 2018. We are into labour saving devices, making automation affordable and think everybody is looking at that. We will be adding more new products in terms of automation and value addition this year. Hence, we expect very good growth.

Deepak Chawla Xcel Stiro Pvt Ltd

Last year industry faced lots of ups and downs. We have increased our business because of simple reasons as we are not restricted to the garment industry which was not doing prominently good. Since we are catering to hotels, hospitals and commercial laundries also we are definitely going to have 15 per cent increase in our turnover this year. Despite of the very shaky conditions, we are happy that we increased our turnover, hence we are fine. Otherwise the industry faced lots of fluctuations in terms of GST and demonetization but we are not affected as in our segment we always do fare/cheque transactions, so mainly the problem came to the segments which had cash transactions, which we never do. GST has helped in reducing down machinery prices, now everything is settling down and is good for long term. It is not me and you who matter but this step is going to take the country along. At the end of the day country matters, if it does well the people will also do well. We had tremendous business last year after collaboration with IIGM. Our third factory will be ready in short time and we will invest heavily on our infrastructure.

Harish Paliwal Yamato Singapore Pte. Ltd.

As far as our company is concerned, yes we were a little affected by last year’s turmoil and our sales were not like previous years. GST is a very sensitive matter and it will be too early to predict about its impact. But as per customers, they are still struggling with the implementation. Everyone is appreciating GST but the kind of implementation and process it has got that is not very simple.

As a company, 2016 was a better year when compared to 2017 which was a little down. Next year we are expecting to do well as markets like Jharkhand, Ranchi, Orissa, Kolkata markets are booming. After GST implementation, tax system has become more simplified, transparent, and calculation has become very easy. I think the govt. should help exporters by coming up with the policies which could increase their business. Besides, GST refunds should be given faster so that their blocked capital could be used by them. Better infrastructure and facilities should also be provided. As a company we are expanding, as of now we have presence in major places like Delhi, Tirupur, Ludhiana, Bangalore, and now we are expanding ourselves to Kolkata to Mumbai, Ahmedabad basically covering Western region more.

Vishal Sher Studio Next Technology Pvt. Ltd.

I believe that the Indian garment manufacturing industry has exhibited good performance in the last year and set higher benchmarks globally. The latest political & economic developments, backed by a strong vision as well as execution, have benefited this industry significantly. It is remarkable to note that there was a surge in sales orders during demonetisation and the industry survived it. GST is yet another initiative which has invigorated widespread development and growth in this sector. Government schemes on Technology Up-gradation, Make in India, Start-up India also added zest to this movement.

Government support is helping to sustain and grow the Indian garment manufacturing industry. Government initiatives and support policies are expected to nurture the same significantly in the near future. I look forward to more government initiatives supporting labour reforms in this sector. Their support will also be very critical in job creation and firming India’s spot in the global textile and apparel market. Pursuant to such initiatives, we can expect the Indian textile and apparel industry to overtake the textile markets in other countries in terms of export, in the long run.

Smarth Bansal Colorjet India Ltd

Demonetisation after effects and GST lead to slow down in the textile industry but by the end of the year the market seems to be reviving and as ColorJet we have seen a steep rise in demands for digital textile printers and the forecast for the year 2018 also looking positive as a lot investments are coming in this particular segment of digital printing.

Today, the major cost in garment manufacturing is labour cost and to since India’s labour cost is also not to competitive we have to ensure more efficiency in production process. Also by adding more technologies like digital printing in-house setup, they can create new and unique designs which will give them an edge over others. I think government should focus on bringing eco friendliness and greener approaches in complete textile value chain and thus contributing towards environment also.

Sandeep Singh Dhingra Stitch Technologies India Pvt Ltd

For Tajima year 2017 was fantastic as we have sold over 90 machines in Delhi NCR and over 200 machine pan India. For the Indian textile industry, it has been one of the most challenging & turbulent years. First demonetization adversely affected sales, which saw a sharp decline compared to growth in preceding years. Payment conditions went for a toss as there was acute shortage of cash because even today major chunk of Indian textile industry falls under unorganised sector & deals primarily in cash.

The govt. should give special impetus on setting up of state-of-the art textile parks with provisions for green energy, sewage treatment plants and operating of the under used sea ports of this country. Other than it should expedite the subsidy schemes and should announce special incentives for the garment exporters based upon their export revenues the more the revenue the more the incentives. It should also give some State subsidy to the garment exporters and also.