The Central Government is undeterred by the flood of imports of textile goods with customs duties coming down substantially post GST. The countervailing duty and the special additional duty on these claims have been abolished making import s cheaper. There has been surge imports of yarn, fabric and made-ups during July – October this year. Imported garments from Bangladesh whose production cost is lower than India pose a big challenge to our industry. And, Bangladesh does not have to adhere to the Rules of Origin (ROO) provision included in India’s Free Trade Agreements with all countries Including Bangladesh, Sri Lanka and ASEAN. Surprisingly enough, New Delhi had offered this concession not to use Indian materials such as yarn or fabrics in Bangladesh’s garment making for export to India. The occasion was the agreement between the Indian Prime Minister and his Bangladesh Counterpart way back in September 2011.

The agreement provides for zero duty access to 45 textile products from Bangladesh. From purely economic reasons, India’s gesture to help Bangladesh, a least developed country is practically with no return. These products cover about 90 per cent of Bangladesh’s exports.

Moreover, Bangladesh is extremely competitive with low wages and power cost and liberal labour laws enabling atto set up big factories, achieving economies of scale. The concessions to Bangladesh will have the potential of India replacing the European Union as the largest importer from Bangladesh over a period of time. Investment from China and other South East Asian countries will pour into Bangladesh targeting the Indian market which is not available to them duty free. Since it is the apparel industry that provides the demand pull for the whole textile value chain the entire sector is bound to be impacted by the additional imports from Bangladesh.

By not including the ROO provision in the India – Bangladesh agreement, the Indian textile Industry is bound to collapse over a period with the flood of imports from Bangladesh. Nothing prevents Bangladesh from using Chinese yarn and fabric for garment production for export to India.

Concessions to Bangladesh started with zero duty access for some garments to be produced out of new materials imported from India. Meanwhile the stipulation that the raw materials should be sourced from India got removed. Then came the demand from Bangladesh for zero duty access for silk products and the 45 apparel products without any quantitative limit in question. This has been accepted by the government in the agreement.

The flood of imports from Bangladesh implies death knell for about 18 mn people employed in our garment industry. The government was well aware of this threat but didn’t insist on use of local material content for political reasons only. How much political support will India get from Bangladesh only time can tell. The interests of the Indian textile industry have often been sacrificed in our trade agreements for the benefit of some other sectors or for geo-political objectives which may or may not be achieved. The South East Asian Free Trade Association (SAFTA) the agreement with Asian and all the bilateral agreements with Asian countries are examples of this approach.

To protect the local yarn, fabric and garment producers from cheap import threat. There is an urgent need to hike the import duty on MMF yarn and fabric as well as cotton fabric by 15 per cent as recommended by the confederation of Indian Textile Industry (CITI).

It is also imperative, according to CITI to impose safe-guard measures such as ROO yarn forward and fabric forward rules on countries like Bangladesh and Sri Lanka to prevent cheaper fabrics produced from countries like China routed through these countries. Rules stipulate that yarn or fabrics should be manufactured in India or Bangladesh for example.

Another area where the textile industry faces challenges is the fabric segment. It suffers from high cost in competitiveness due to exogenous factors over which a manufacturer has no control. Refunds due to the sector are yet to be resolved. The refunds arise from high incidence of blocked / embedded taxes / levies / surcharge etc of about 5.33 per cent embedded in export consignments. It is known that China gives a 17 per cent rebate for fabric exports which works out to an implied subsidy of 8 to 10 per cent. Bangladesh grants 5 per cent subsidy to its garment exporter if fabric used is made from yarn sourced locally to promote the domestic value chain. Fabric producers also suffer from high transaction cost. Also interest rate in India is much higher than China. Hence fabrics should be included in the Remission of State levies (ROSL) package for a period of 3-7 years, recommends CITI.

A major portion of India’s population is engaged in garment manufacturing and it learns substantial foreign exchange. Therefore the government must revisit the GST provisions with regard to the garment sector to make this business viable and sustainable. Duty draw back and ROSL for the garment sector should continue at the same rate as pre-GST regime. Also the transitional rate of duty drawback and ROSL should be extended upto March 31, 2018, so that sufficient time is available for sorting out GST issues and calculating new rates.

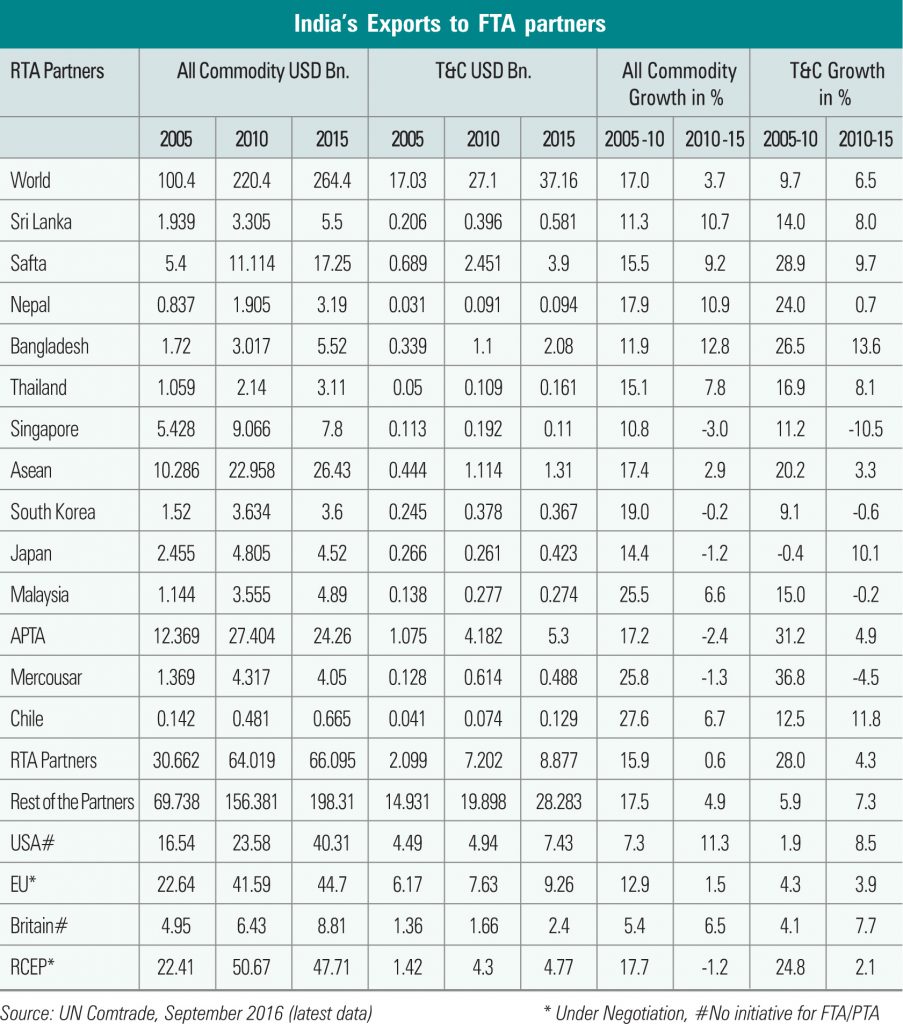

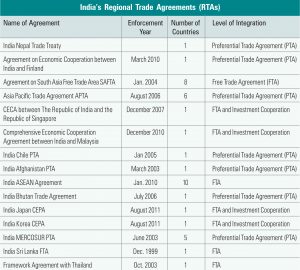

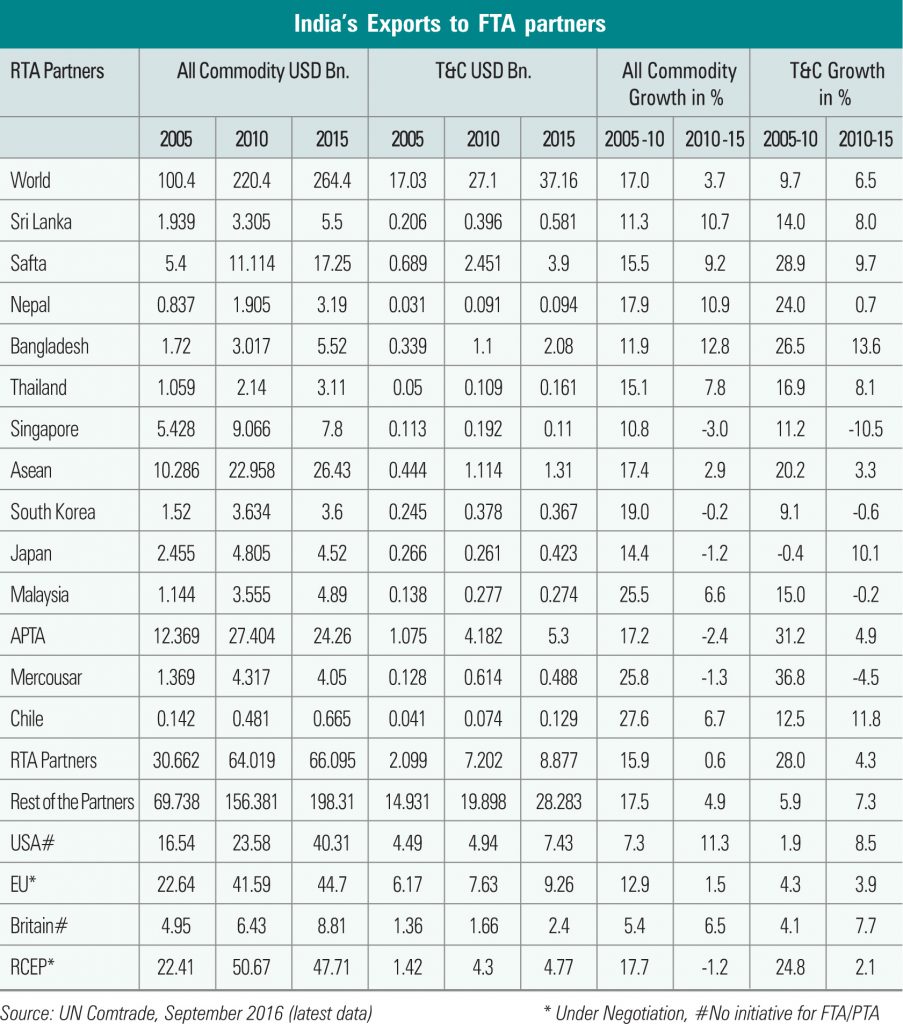

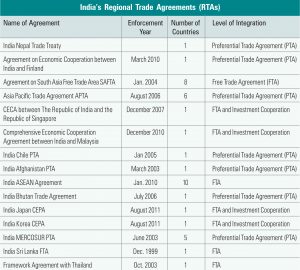

There are more than 300 regional trade agreements (RTA) in force globally. So far, India has signed only 16 RTAs which are in force and around 17 agreements are in the pipeline for which negotiations are on. Combining all partners of RTAs with which India has signed agreements shows that together these account for a 30 per cent share in global GDP and caver a significant geographical area of the world. These partners have a combined share of around 33 per cent in global imports. Therefore, India’s current agreements, which are in force covers roughly one third of the globe.

India’s FTA with Sri Lanka is the oldest one while with Japan, it is the latest one, which was signed in August 2011. Since 2011 India has not signed any new agreement though negotiations for RTAs are on with more than 17 trading partners. Amongst them, RECP and the EU are major ones.

Economies with which India has signed agreements, almost all are from high income to low income under developed countries, though a majority ones are from middle income developing countries to low-income under developed countries. This indicates that India has so far not gone to engage with Western developed markets which are considered as the net importers of durable and non durable commodities.