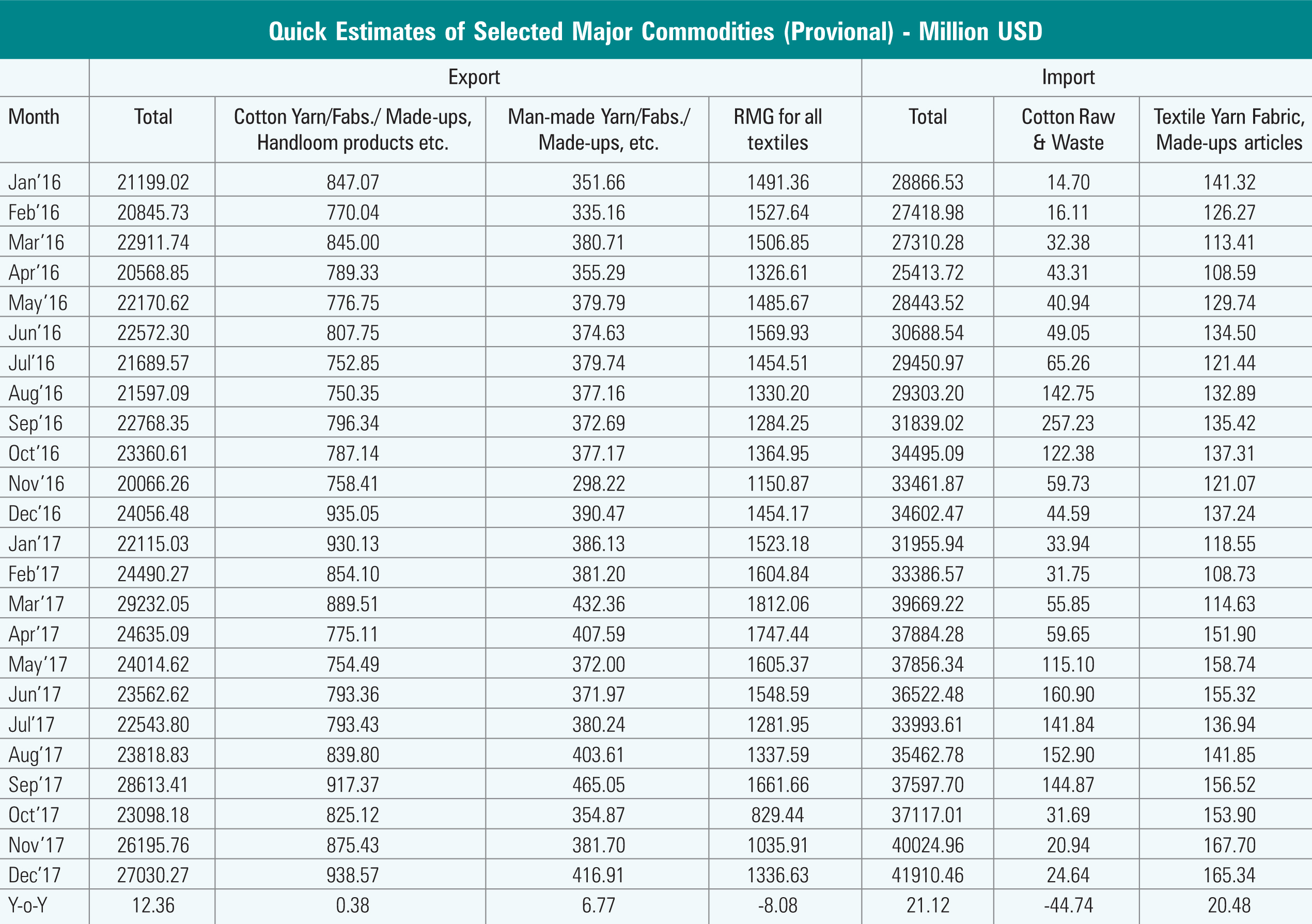

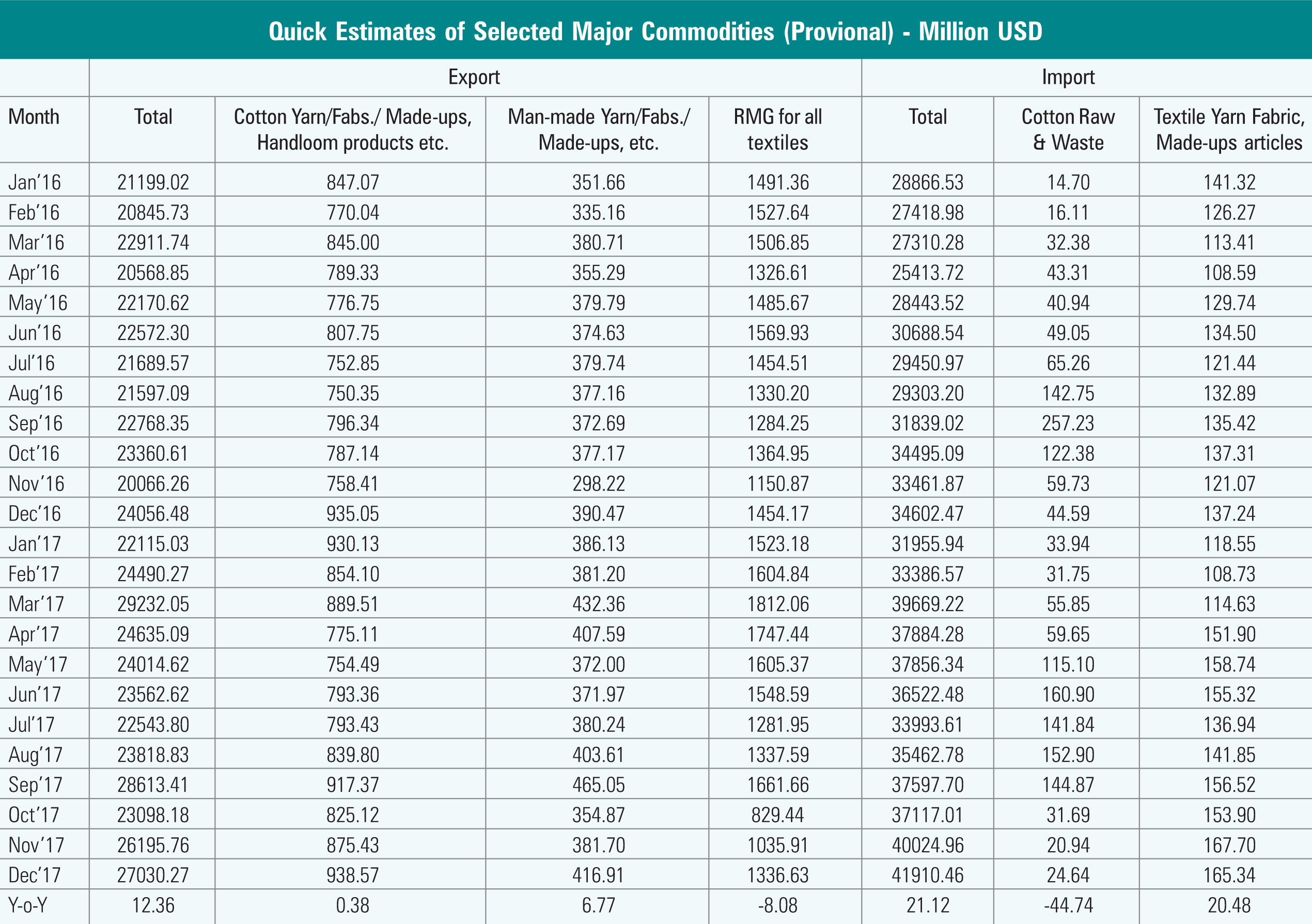

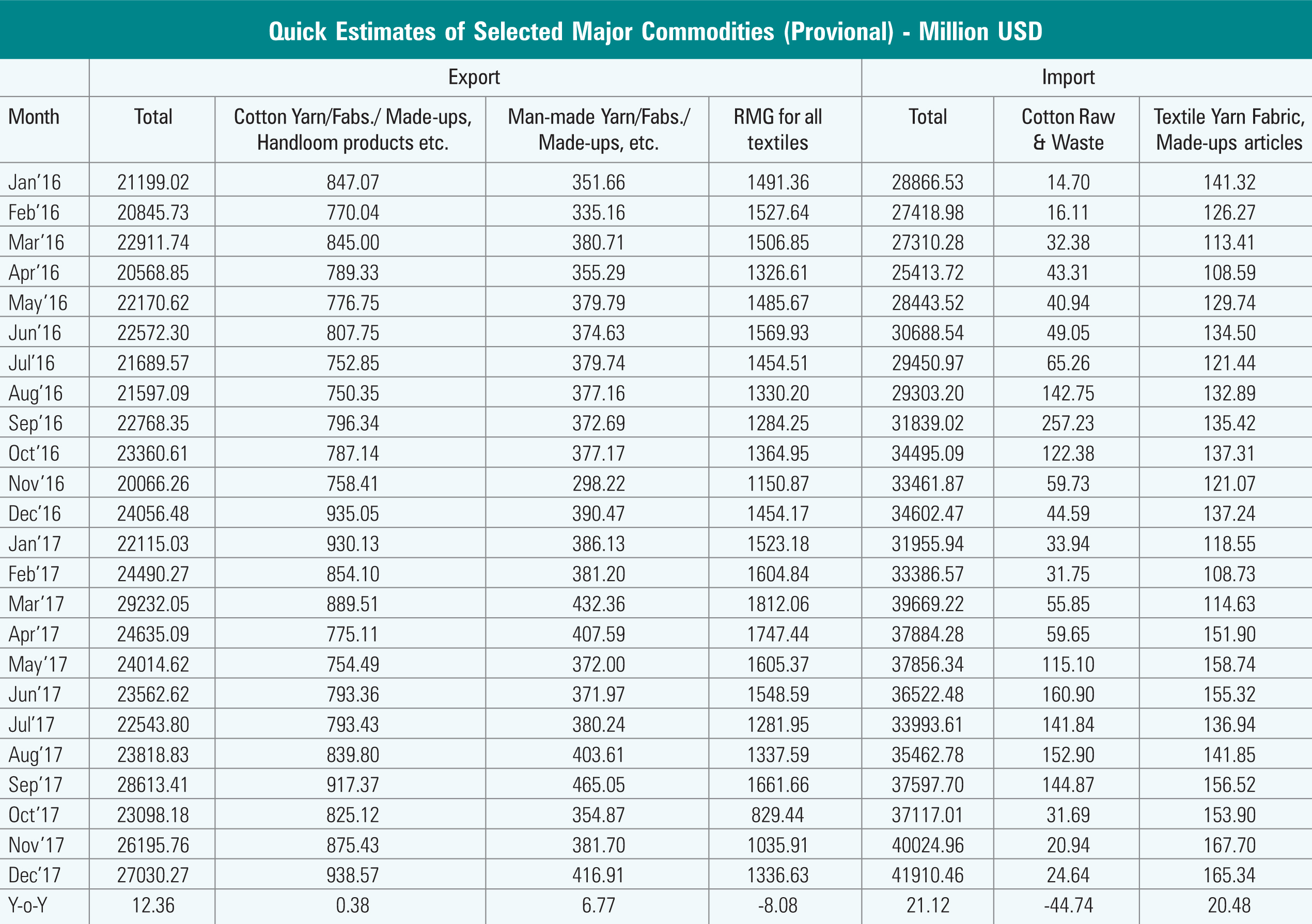

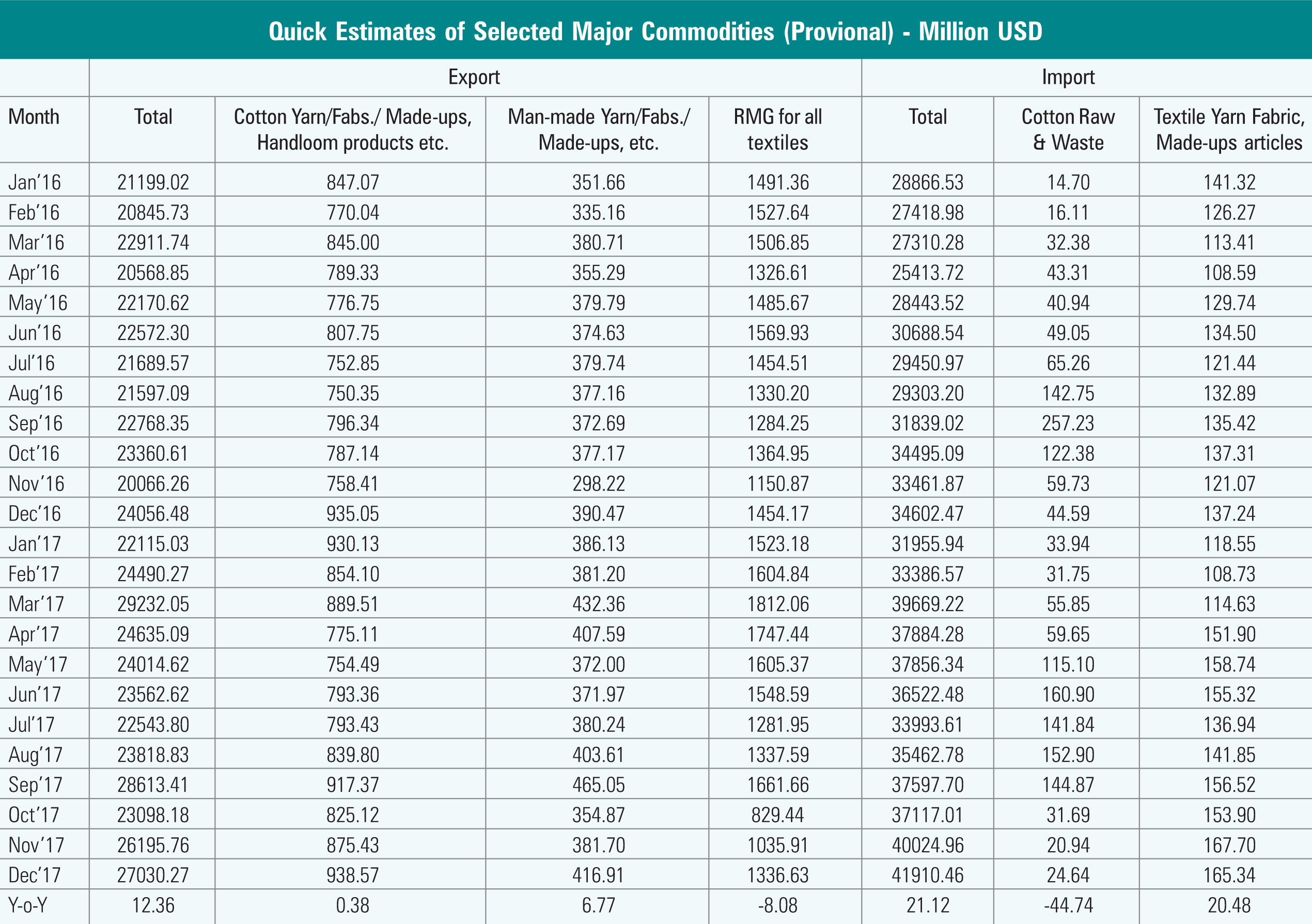

Some urgent remedial measures are called for to rein in the sudden surge in imports of textile materials following the abolition of the countervailing duty and the special additional duty on these items, post GST. In the absence the country’s textile and clothing (T and C) exports face a bleak future. Already there are ominous signs, with the imports rising sharply by 20.48 per cent in January, December 2017 over the same period in 2016, as per the latest data available. Total exports of readymade garments, the major item in the textiles export basket have declined by 8.08 per cent during the same period. This has set the alarm bell ringing in the Union Finance Ministry to have a “relook” at the threat of cheaper imports of textile materials from neighbouring countries. The task of achieving the ambitious target of dollar 350 bn worth of business in the textile industry by 2020-25 will remain a pipedream.

What are the remedial measures? One could be restoring the Pre–GST incentives for exports. Another could be the protection that prevailed before GST to prevent cheap imports. Again, raw materials, especially man-made fibres and filaments should be made available to the T and C industry at international prices so that it could have a level playing field with competing countries. Among the raw materials, cotton fibre is duty free. It is not the case of MMF items such as fibres and filaments that about 25 per cent customs duty. Thus these items are more expensive compared to China.

Currently, the total textile business volume is $127 bn, of which $40 bn constituted exports and the rest $87 bn represents domestic operations. Of the $350 bn target, $150 bn is for exports and $200 bn is for domestic operations. To achieve the target, 22 bn kg of fibres and filaments are required. But the availability is only a billion kgs. To bridge the gap the solution lies in allowing imports, duty free.

In addition, a “stimulus” package needs to be worked out in order to render the “Make in India” meaningful and effective. Such a package was made available during 2008-09 following the global meltdown. Essentially the package envisages a 3- 5 per cent interest subvention and export incentives at the same level. Besides, a one-year moratorium on payment of loans taken by the T and C industry is called for. Under this, moratorium is for payment of the principal amount.

As per the latest data, total yarn exports amounted to 119.56 mn kg in October 2017, down from 155.56 mn kg in October 2016. Total fabrics exports also declined from 175.35 mn kg to 157.70 mn kg during the same period.

Exports of manmade fibre were marginally down from 120.63 mn kg to 109.87 mn kg, those of man-made spun yarn declined from 25.31 mn kg to 20.82 mn kg and those of the RMG and apparels or garments also came down from 311.12 mn kg to 200.86 mn kg. Imports of yarn were worth 5.67 mn kg while those of fabrics amounted to 13.73 mn kg. Imports of RMG and apparels were 20.30 mn kg during the period under review. India has the second largest installed capacity in textile mills world-wide. In the last one and a half decade there has been a significant increase in the installed capacity in spinning mills and composite mills, though growth of spinning and standalone spinning have been higher than the composite mills. Currently, India has 3,367 textile mills, of which 6 per cent are composite, while the rest are standalone spinning mills.

Of the total mills, 60 per cent are non-small scale units (non SSI) while 40 per cent are small scale units. In the total installed spindling capacity SSI accounted for 10 per cent, while 60 per cent belonged to non –SSI units suggesting higher scale of operation in favour of non SSI units for the spinning sector. In terms of rotors, SSI sector accounts for 33 per cent of the total installed capacity, while the rest is accounted for by non SSI units. Installed looms capacity is totally with the non SSI units accounting for 99 per cent of the total capacity.

There have been huge fluctuations in the growth of mills and their installed capacity over the last one end a half decade. Growth of spinning mills has slowed down. However, composite mills, which were in the negative zone during 2001-05 and 2005-10 have moved up and reached the positive zone in the subsequent years though the magnitude of growth had slowed down during APPAREL VIEWS / MARCH 2018 31 2014-17 compared to 2010-14. Total number of mills had grown in the last one end a half decade and has been growing at a satisfactory pace though addition of mills had slowed down during 2014-17.

Spindles, rotors and looms have also shown a positive growth in the installed capacity of mills, though with varying pace. Currently, India has 52.47 mn spindles installed in the mills sector around 8,78,000 rotors and 53,000 looms installed in the mill sector. Over the last 15-17 years installed capacity has gone up significantly. Similarly, rotors and looms have also moved up. Growth of the installed capacity of spindles and rotors in mills has come down compared to previous periods.

As the provisional estimates, spun yarn production was minutely down during 2016-17 over 2015-16. During 2016-17, total spun yarn production was lower by one million kg. In percentage terms, total spun yarn production was almost stagnant over the preceding year. Production of cotton yarn, blended yarn and hundred per cent non cotton spun yarn was 4,059 mn kg, 1,034 mn kg and 571 mn kg respectively in 2016-17. Total spun yarn production was around 5,664 mn kg. Provisional data shows that cotton yarn production has declined by 79 mn kg. Blended yarn production had increased by 62 mn kg and hundred per cent non cotton yarns had gone up by 18 mn kg in 2016-17 over the previous year.