Just over a month left for the Donald Trump to assume office as the 43rd President of the United States. Immediately thereafter, he is expected to swing into action to redeem the promises he had made during the election campaign. Pressure will mount on India to reduce tariffs and brace for higher tariffs on its textile exports to the US.

Just over a month left for the Donald Trump to assume office as the 43rd President of the United States. Immediately thereafter, he is expected to swing into action to redeem the promises he had made during the election campaign. Pressure will mount on India to reduce tariffs and brace for higher tariffs on its textile exports to the US.

Higher levies could render these exports uncompetitive in the American market and come at a time when there are signs of a decline in apparel exports to th US in the first quarter of this year. (January – March 2024) over the same period last year – from $ 1332 mn to $ 1125.26mn. China’s exports in this period also fell from $ 3495.26 mn. To $ 3470 mn.

While higher duties could pose challenges for Indian exporters, it also presents opportunities to capture a large share of the US market, especially given the political turmoil in other major textile exporting countries like Bangladesh, said a senior textile industry leader Indias chief economic adviser has stressed the need to brace for these potential increase and adapt to the evolving landscape. “Navigating these changes will require stratergic adjustments and a focus on enhancing competitiveness to mitigate the impact of higher tariffs.

Global agencies such as IMF and World Bank have pointed to the need for India reducing its tariffs. And Union Finance Minister Nirmala Seetharaman has hinted at lifting some tariffs, if they do not hurt domestic companies. She asserted that there is need to balance the interest of companies which need imported inputs. It is possible to explain every tariff that has to be levied and those that were not imposed to control imports.

She said “inputs are required intermediate goods are required to be imported. I will have to encourage that. I will lift the tariffs on them, provided it does no intended or unintended having my own capacity to produce. I will to balance the two”, Seetharaman stated.

She further said in response to a question on Trump’s proposed tariff policy “Do we have a moral authority or will or nip in the bud those who are growing in India and who can produce in India? I need to give them that protection as well as I have to encourage industries which need those imports” Reports have it that Trump may bring in wider measures including a 10-20 percent charge on all imported goods and 60 percent on Chinese goods.

Trump considers China as the “toughest” and India “tough”. Given that perception, the prime focus of his actions is likely to be on Beijing. And if he raises tariffs for countries like India by a lower magnitude than China, then it stands to gain, says Jayant Dasgupta, India’s former Ambassador to WTO.

Again in 2023 China’s goods exports to the US were estimated at $ 427 bn five times higher than India’s $ 84 bn.

So he will come down heavily on China. All these may potentially open the doors for some Indian businesses, provided they have the capacity to produce these goods required by US customers.

When it comes to tariffs, India is not alone. There are several countries around the world that keep high levies on products that are “sensitive”. With Trumps return they are bracing for fresh trade tensions.

Trump believes import taxes can help shore up revenues as well as reduce US trade deficit and reshore manufacturing. The self proclaimed “tariff man”, Trump had in his first term in office enacted duties on about $380 bn in imports. He had also demonstrated that the President can enact tariffs essentially single –handably.

Last time, he had called India “Tariff king” and went on to increase import duty on steel and aluminum by 10-25 percent invoking national security provisions. It impacted 2.3 percent of India’s trade with the US and New Delhi responded with retaliatory tariff on almonds, apples, lentils and steel after preferences were also withdrawn by the Trump administration. He had then indicated his preference for “tit for tat” tariffs“ so we are going to do reciprocal trade. If anybody charges us 10 cents, if they charge us $ two, if they charge us 100 per cent, we charge the same”.

He does not believe in looking at average tariffs or if the levies are within permissible limits.

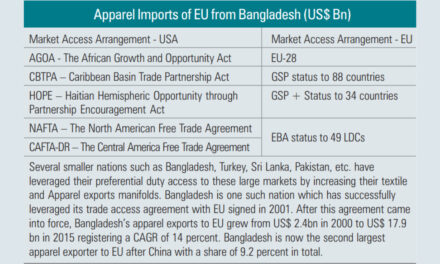

The average tariffs in US on textile products range between 15 percent and 16 percent. For India, it is curtains down on the special market access granted by Washington under its Generalised Scheme of Preferences (GSP) Scheme, Washington believes that India’s tariffs on American products are high enough and is continuing with several export promotion schemes which have an element of subsidy. EU has already stopped benefits to India under its GSP scheme.

For textiles nearly 99 percent of products are not covered by GSP. The remaining one percent coverage have most favoured nation (MFN) duties (normal duties) of just 2-3 percent. Thus the US withdrawal of GSP is a “non- issue” according to some trade experts.

Further, an analysis by the Federation of Indian Exports Organisations (FIEO) reveals that the duty advantage under GSP is on 5,111 items out of 18770 tariff lines. For over 2,110 items, the advantage is 4 percent or less. Exports with over three percent duty preference are likely to be affected.

While an FTA with the US will majorly improve India’s share in the US apparel imports, New Delhi has termed the idea as “fanciful”. A study by FICCI and Wazir Advisors says that from a value of 5-8 percent, it could increase as high as 20 percent by 2025. India’s share in the US’s import of textiles – yarn, fabrics and made – ups – will also increase substantially in segment of MMF yarns and fabrics.

As reported in these columns earlier the current global apparel market is worth $ 1.7 trillion and it constitute around two percent of GDP. EU – 27 US and China are the largest apparel markets with a combined share of 54 percent. The global apparel market is expected to touch $ 2.6 trillion by 2025 by a projected rate of 4 percent. The major growth drivers are the developing countries, mainly China and India, growing in double digits.

According to official data the US was India’s top trading partner in 2022-23. India’s exports at $ 78.5 bn came down from 78.5 bn to $ 77.5 bn in 2023-24. Imports declined from $ 50.5 bn to $ 42.2 bn. In this period total trade at $ 129.3 bn came down to $ 119.7 bn.

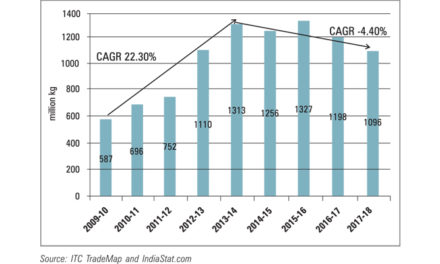

The data show that India’s textiles and clothing exports to the US which was 10.8 bn 2020-21 and 2021-22 dropped to 9.3 bn in 2022-23. Exports at $ 8.1 bn 2017-18 increased to $ 8.5 bn in 2018-19 but declined again to $ 7.5 bn 2019-20. Total textile and clothing exports to the US in the last 6 years were valued at $ 37.1 bn, $ 35.5 bn, $ 29.6 bn, $ 41.5 bn, $ 38.3 bn and $ 34.2 bn respectively.